5

As at 31

st

December 2015, Kuwait Energy’s WI Proven and Probable (“2P”) reserves are

818 mmboe

; a significant

increase from the previous year by almost 22%. The WI contingent resources (“2C”) is

942 mmboe

and the best

estimate of risked prospective resources (“P50”) is

34 mmboe

.

It is worth noting that the valuation of a private E&P company is most commonly based on its audited reserves and

associated economic models.

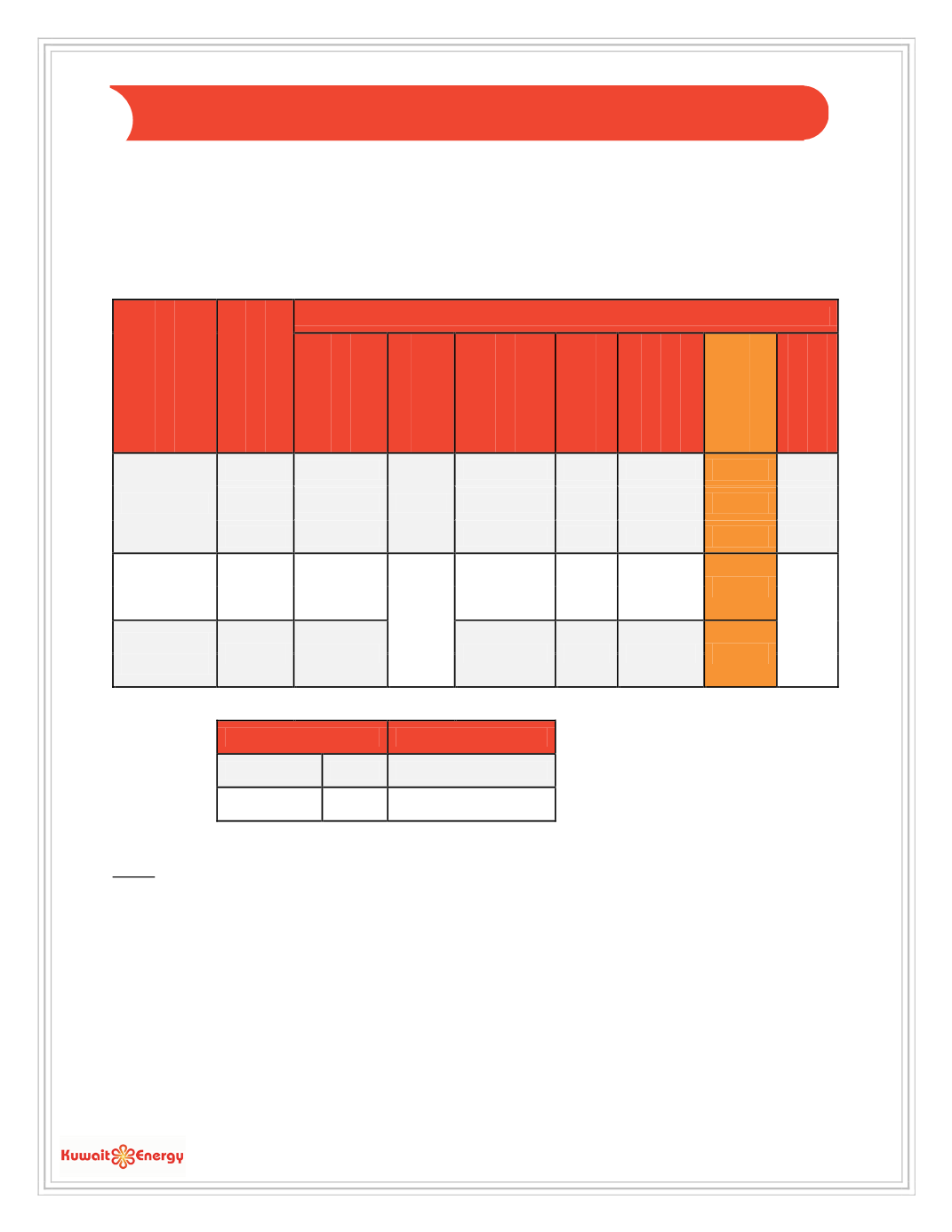

Classification

Category

Kuwait Energy Reserves and Resources (in mmboe)

YE14

2015 Production

Exploration Adds

Revisions

Acquisitions &

Divestments

Year-End 2015

YE15 Net

Entitlement

Reserves

1P

259

-8

0

97

-37

312

85

2P

671

1

264

-110

818

137

3P

1,232

2

667

-242

1,651

218

Contingent

Resources

2C

759

0

266

-84

942

Prospective

Resources

Best

32

0

2

0

34

Total

YE15

YE14

1P RRR =

780%

1P RRR = 2,337%

2P RRR =

1,986%

2P RRR = 6,186%

Notes:

Audited figures by GCA as of 31 December 2015.

Excludes KSF, Oman which cannot be included in external reserves reporting as per the service contract.

Reserves Replacement Ratio considers acquisitions and divestment.

Prospective Resources estimates are risked.

N/E stands for Net Entitlement.

Totals may not exactly equal the sum of the individual entries due to rounding to nearest whole number.

10% of Block 9, Iraq was divested to EGPC effective 1

st

July 2013.

25% of BEA, Egypt was acquired from Gharib Oil effective 15

th

January 2015.

2015 production is based on actuals up to November 2015 and an estimate for December 2015.

R

ESERVES AND

R

ESOURCES