KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

38

29.

FINANCIAL INSTRUMENTS (CONTINUED)

Liquidity risk management (continued)

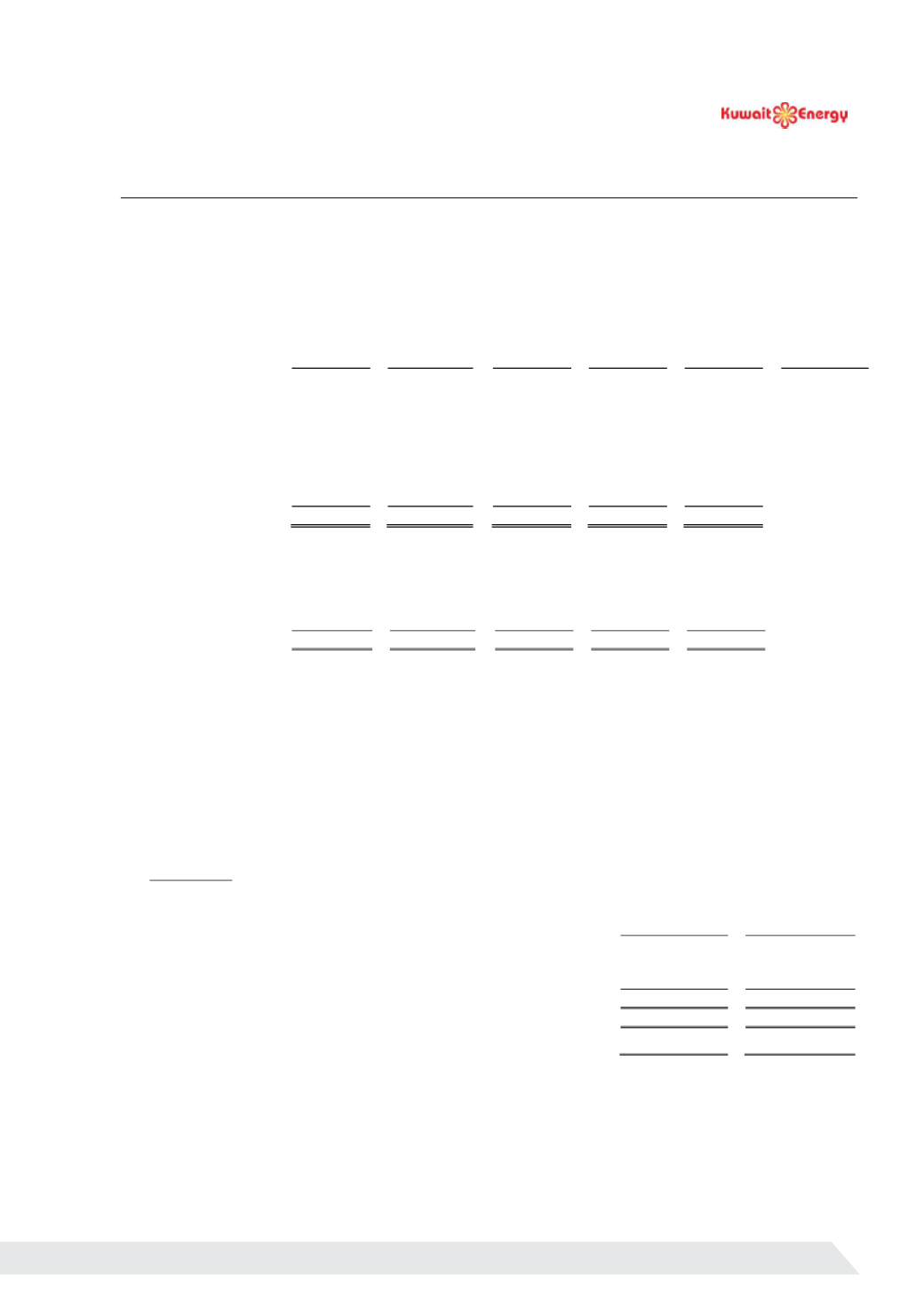

The following tables detail the Group’s remaining

contractual maturity for its financial liabilities (including interest).

The tables have been drawn up based on the undiscounted cash flows of financial liabilities.

Financial liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More than

5 years

Total

Weighted

average

effective

interest rate

USD 000’s

USD 000’s

USD 000’s

USD 000’s

USD 000’s

%

At 31 December 2015

Borrowings

23,750

47,500

273,750

- 345,000

10.6%

Obligations under

finance lease

1,766

2,384

2,085

-

6,235

5.0%

Convertible loans

10,250

100,499

17,325

- 128,074

14.7%

Trade and other

payables

119,659

-

-

- 119,659

155,425

150,383

293,160

- 598,968

At 31 December 2014

Borrowings

23,750

47,500

297,500

- 368,750

10.6%

Convertible loans

9,250

35,500

89,585

- 134,335

12.0%

Trade and other

payables

133,653

-

-

- 133,653

166,653

83,000

387,085

- 636,738

The group has access to financial facilities as described in notes 22 and 23. The group expects to meet its other

obligations from operating cash flows.

Capital risk management

The primary objective of the Group

’s capital management policy is

to ensure that it will be able to continue as a going

concern while maximising the return to the shareholders through the optimisation of debt and equity. The Group

manages its capital structure and makes adjustments to it in light of changes in economic conditions.

The Group’s

overall strategy remained unchanged during 2015.

The capital structure of the Group consists of equity comprising issued share capital (note 20), share premium, other

reserves (note 21) and retained deficit.

Gearing ratio

The gearing ratio at year end was as follows:

2015

2014

USD 000’s

USD 000’s

Total debt (i)

368,372

360,288

Less: Cash and cash equivalents

(105,297)

(215,992)

Net debt

263,075

144,296

Equity attributable to owners of the Company

349,276

407,742

Net debt to equity ratio (%)

75.3

35.4

(i) Debt is defined as borrowings excluding accrued interest, as detailed in note 22, convertible loans as detailed in

note 23 and obligations under finance leases as detailed in note 24.

85