KUWAIT ENERGY PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2015

33

25.

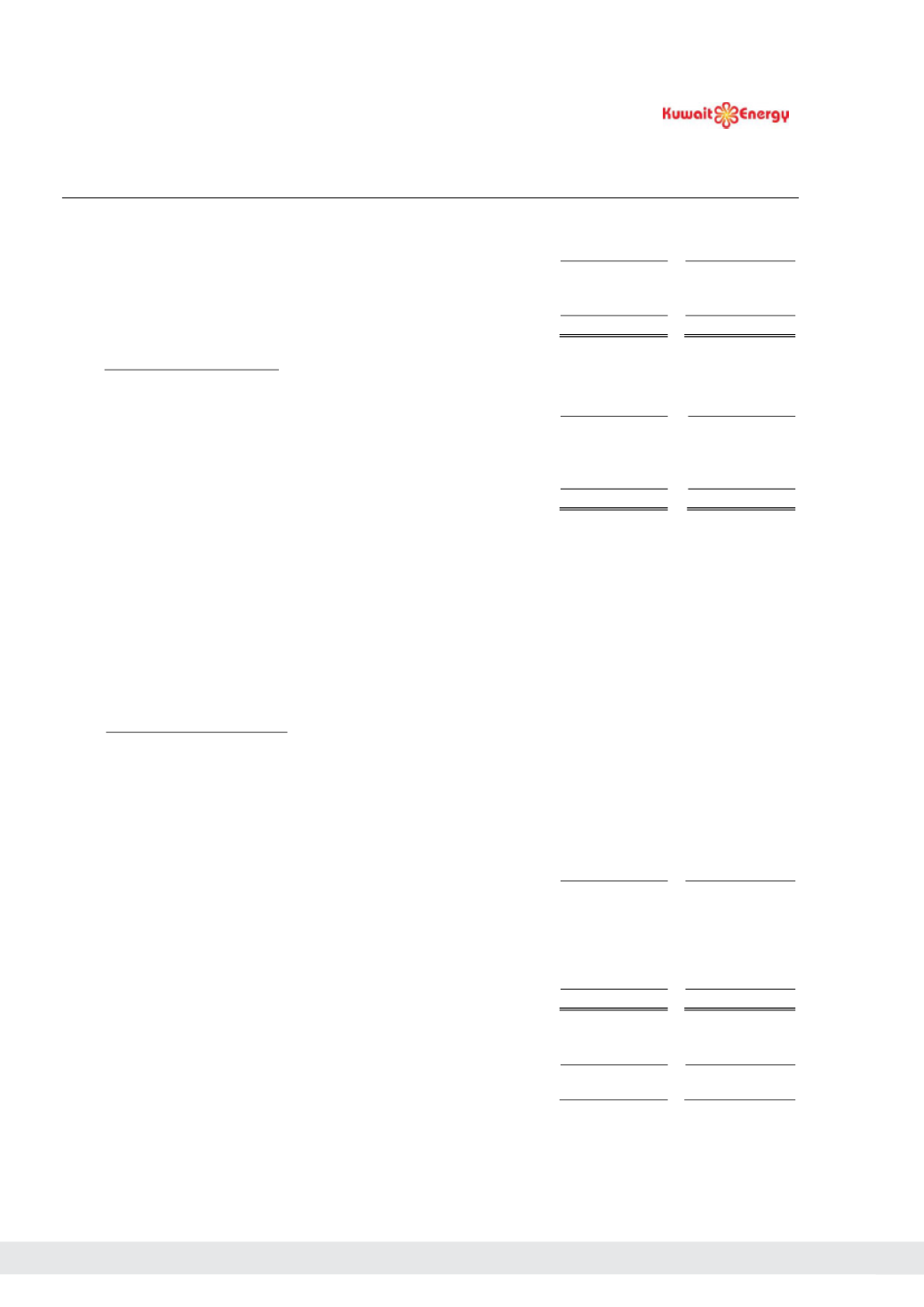

PROVISIONS

2015

2014

USD 000’s

USD 000’s

Decommissioning provisions

12,397

12,433

Retirement benefit obligations

3,061

3,264

15,458

15,697

a)

Decommissioning provisions

The movements in the decommissioning provision over the year is as follows:

2015

2014

USD 000’s

USD 000’s

At 1 January

12,433

3,013

Unwinding of discount

362

104

New provisions and changes in estimate

(398)

9,316

At 31 December

12,397

12,433

The provision for decommissioning

relates to two of the Group’s fields and

is based on the net present value of the

Group’s share of the expenditure which may be incurred at the end of the producing life of each field (currently estimated

as being 2018 and 2023 for the two fields respectively) in the removal and decommissioning of the facilities currently

in place. Assumptions, based on the current economic environment, have been made which management believe are a

reasonable basis upon which to base the provision. These estimates are reviewed regularly to take into account any

material changes to the assumptions. However, actual decommissioning costs will ultimately depend upon future market

prices for the necessary decommissioning works which will reflect market conditions at the relevant time. Furthermore,

the timing of decommissioning is likely to depend on when the fields cease to produce at economically viable rates. This

in turn will depend upon future oil and gas prices, which are inherently uncertain. The Group uses a discount rate of 5%

in arriving at the future value of decommissioning provisions.

b) Retirement benefit obligations

The Group has a post-employment defined benefit obligation towards its non-Kuwaiti employees which is an End-of-

Service (ESB) plan governed by Kuwait Labor Law. The entitlement to these benefits is conditional upon the tenure of

employee service, completion of a minimum service year, salary drawn etc. The Group also has a defined benefit

obligation in respect of the Block 5 in Yemen. These are unfunded plans where the group meets the benefit payment

obligation as it falls due.

The movement in these defined benefit obligations over the year is as follows:

2015

2014

USD 000’s

USD 000’s

At 1 January

3,264

3,243

Current service cost

1,486

1,066

Re-measurements:

Experience gains

(445)

(812)

Benefits paid

(1,244)

(233)

At end of the year

3,061

3,264

The significant actuarial assumptions were as follows:

2015

2014

Discount rate

4%

5%

Salary growth rate

5%

6%

80