8

At the end of Q3 2015, the current debt of the Company is

US$350 million with cash as at end of the quarter of

US$160.0 million including US$100.0 million in short term

fixed deposits. The net debt is US$190.0 million.

The Company achieved Q3 2015 revenue of US$36.1

million (based on management accounts) a decrease of

18.3%, as compared to the previous quarter primarily due

to a lower oil price.

The Q3 2015 capital expenditure was US$ 37.6 million,

US$59 million was collected from Egyptian General

Petroleum Corporation during the Q3 2015.

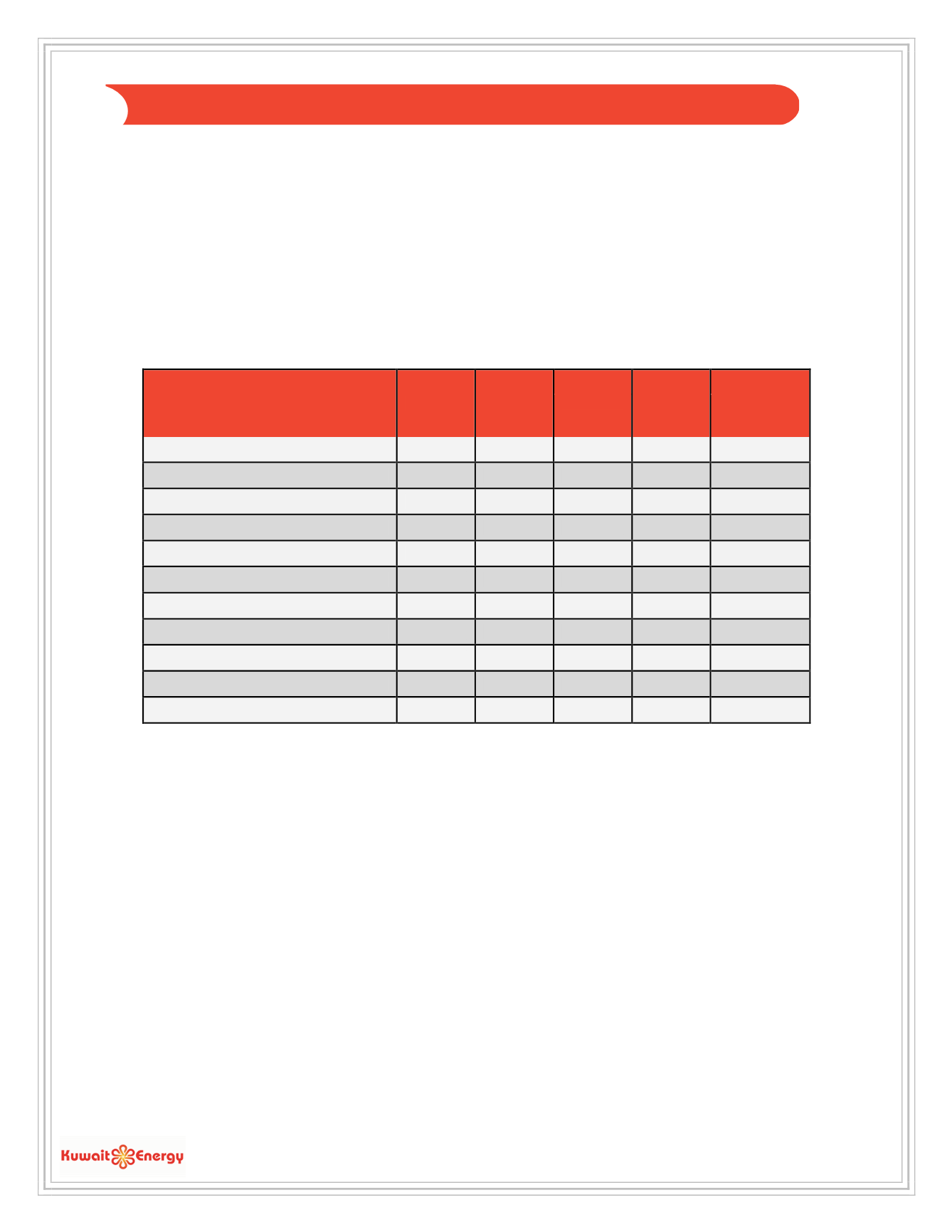

Unaudited Consolidated Financial Highlights

4

Q3 2015

Q2 2015

% Change

Q3 2014

% Change

(Q3 2015

versus

Q2 2015)

(Q3 2015 versus

Q3 2014)

Revenue

36.1

44.2

-18.3%

80.4

-55.1%

Net Profit/(loss) from continuing operations

25.4

2.5

916.0%

10.3

146.6%

Exploration Capex

0.2

2.2

-90.9%

10.2

-98.0%

Development Capex

37.4

60.2

-37.8%

37.6

-0.6%

General and Administrative Expenses

5.2

4.8

8.3%

8.2

-36.6%

EBITDA

52.1

28.5

82.6%

50.5

3.2%

Working Capital

137.9

117.8

17.1%

258.0

-46.6%

Total Assets

940.0

950.3

-1.1%

965.5

-2.6%

Total Debt

5

350.0

350.0

0.0%

350.0

0.0%

Earnings/(loss) Per Share

(US$ cents)

7.8

0.8

916.0%

3.1

148.6%

Outstanding shares

(number of shares in millions)

358.5

358.5

0.0%

352.0

1.8%

F

INANCIALS

4

All figures are unaudited and based on management accounts and are in US$ millions unless otherwise specified.

5

Excluding fair value loss and unamortized initial transaction cost.