103

(3)

The ‘geological chance of success’ is a percentage which represents the estimated percentage probability of achieving the status of a

Contingent Resource (where the geological chance of success is considered to be 100%). This dimension of risk assessment does not

incorporate the considerations of economic uncertainty and commerciality. GCA has presented the Prospective Resources in the

“

Competent Person’s Report

” as unrisked volumes and has not aggregated these volumes. The aggregation and application of the geological

chance of success to derive risked volumes has been undertaken by the Group.

(4)

“Risked Prospective Resources” represent the P50 probabilistic outcome multiplied by the geological chance of success.

(5)

For Abu Sennan in Egypt, the Group has presented the volumes for the “oil” case; in the CPR, GCA also presents a “gas” case, as there is a

chance any discovery may prove to be gas rather than oil.

(6)

Sum totals may differ from sums of line items presented as a result of rounding.

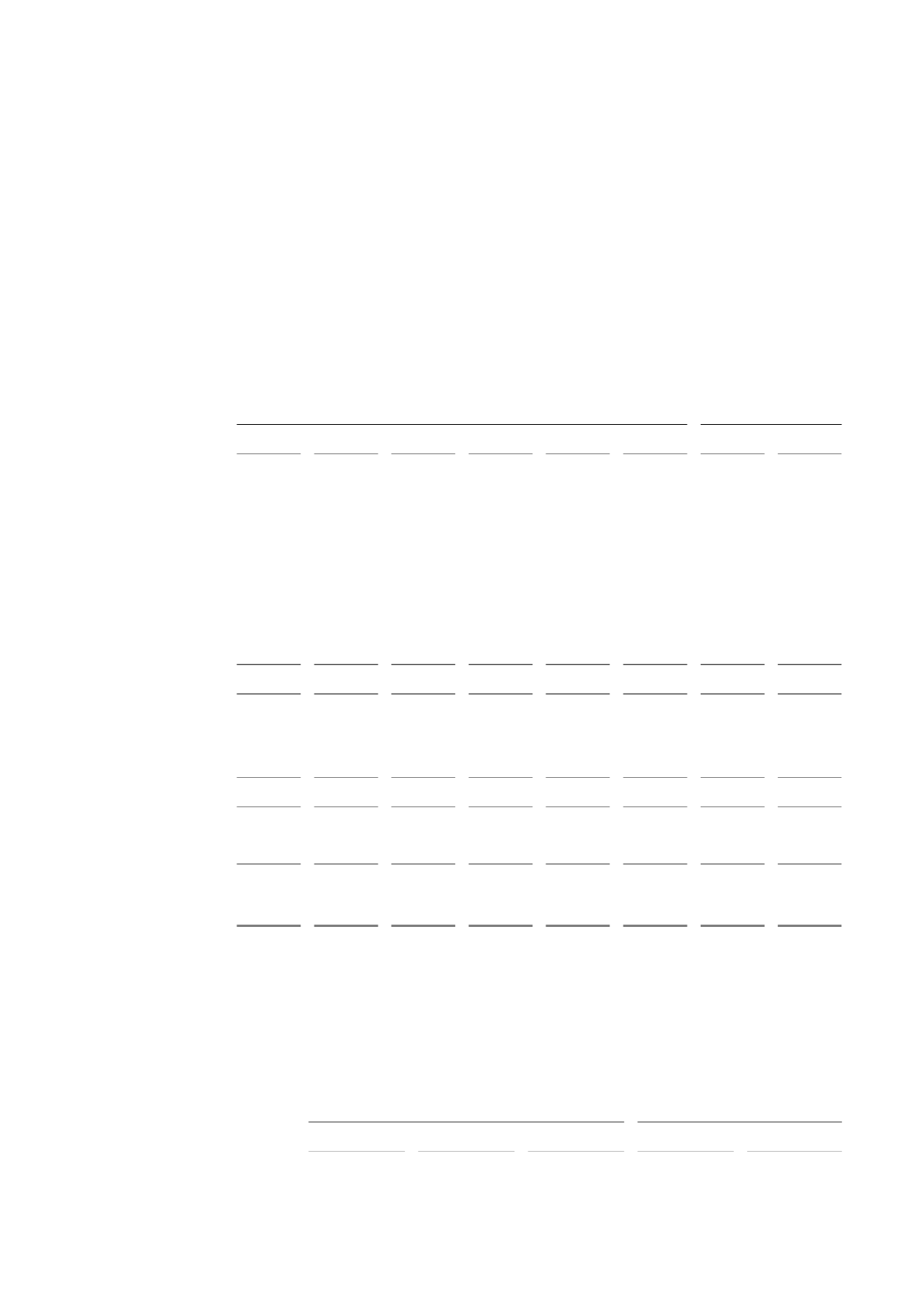

The table below summarises the Group’s average daily oil production on a working interest basis for each of the

jurisdictions in which it has producing assets. For information about the movements in the Group’s hydrocarbon

production between periods, see “

Management’s discussion and analysis of financial condition and results of

operation—Results of Operations

.”

Year ended 31 December

Three months

ended 31 March

2008

2009

2010

2011

2012

2013

2013

2014

(boepd)

Location

Egypt

Abu Sennan ............... -

-

-

-

204

445

331

690

Area A ....................... 1,729

4,008

4,386

4,210

4,434

4,351

3,959

4,178

Burg El

Arab ...........................212

193

348

423

1,144

882

837

951

ERQ...........................798

2,092

3,420

3,896

6,672

8,876

6,250

9,695

Egypt Total

.....................................................................

2,738

6,293

8,154

8,529

12,454

14,553

11,377

15,514

Yemen

Block 5 ...................... -

-

-

-

656

4,185

5,108

4,012

Block 43 .................... 1,185

1,093

776

636

563

532

645

376

Yemen Total

...................................................................

1,185

1,093

776

636

1,219

4,717

5,753

4,388

Oman

Oman KSF

(1)

....................................................................

2,128

2,635

2,758

2,825

3,065

2,628

2,829

2,566

Group average daily

working interest

production

......................................................................

6,051

10,021

11,688

11,990

16,738

21,898

19,959

22,468

(1)

Reflects the contribution of the Group’s 20% interest in Medco LLC, which holds a 75% working interest in the Karim Small Fields in

Oman. As the Group does not control Medco LLC, under IFRS 11 Medco LLC cannot be consolidated with the Group’s revenue or expense

items on its consolidated income statement. The Group’s interest in Medco LLC is therefore accounted for in the Group’s consolidated

income statement under “Net result from joint venture.”

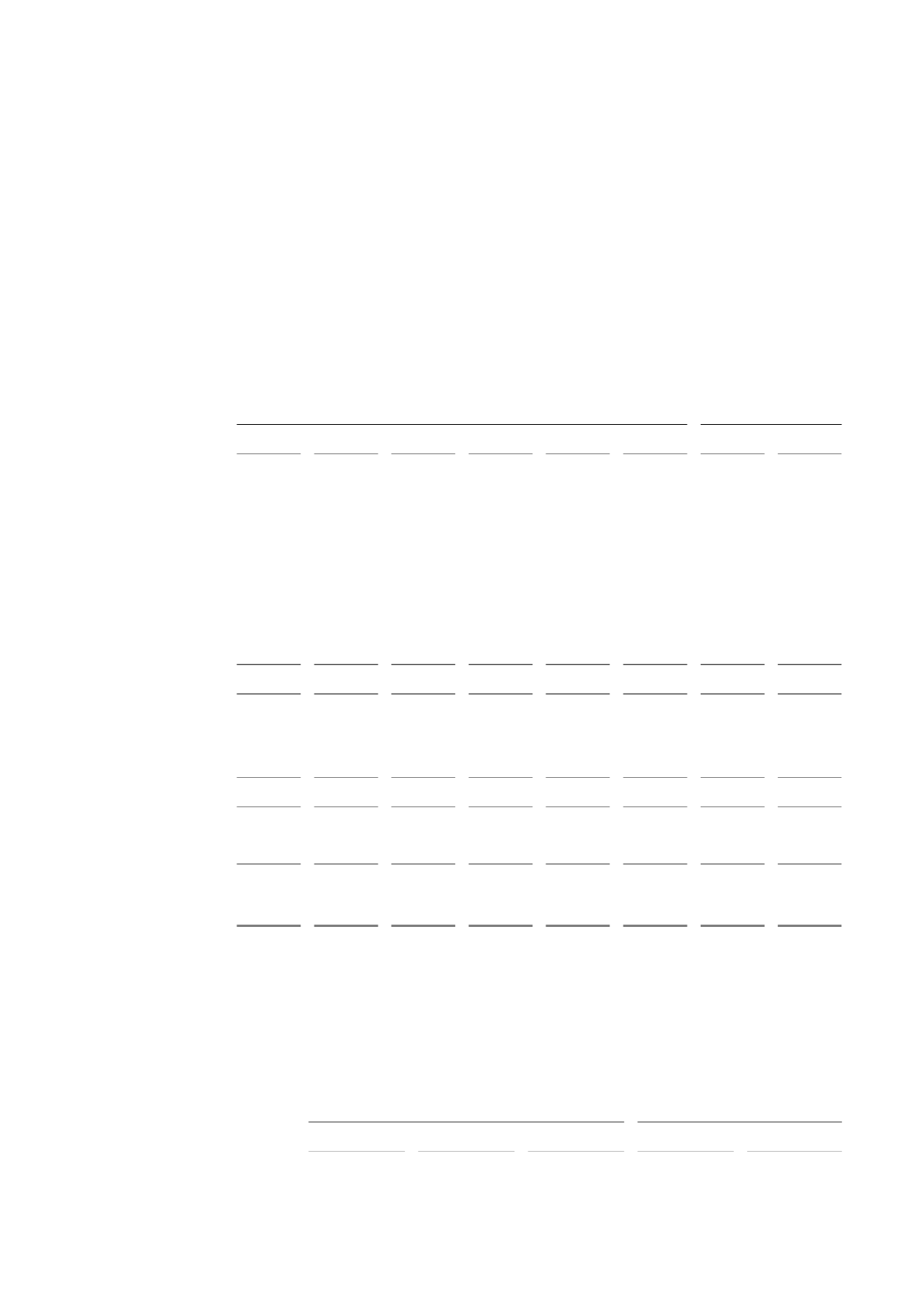

The table below presents certain Group operating data for each of the time periods indicated. See “

Presentation of

financial and other information—Non

-

IFRS financial measures

.”

Year ended 31 December

Three months ended

31 March

2011

2012

2013

2013

2014

Benchmark – average

International Brent Crude oil

price ($ per barrel)

(1)

...................

110.9

111.7

108.7

118.4

112.6