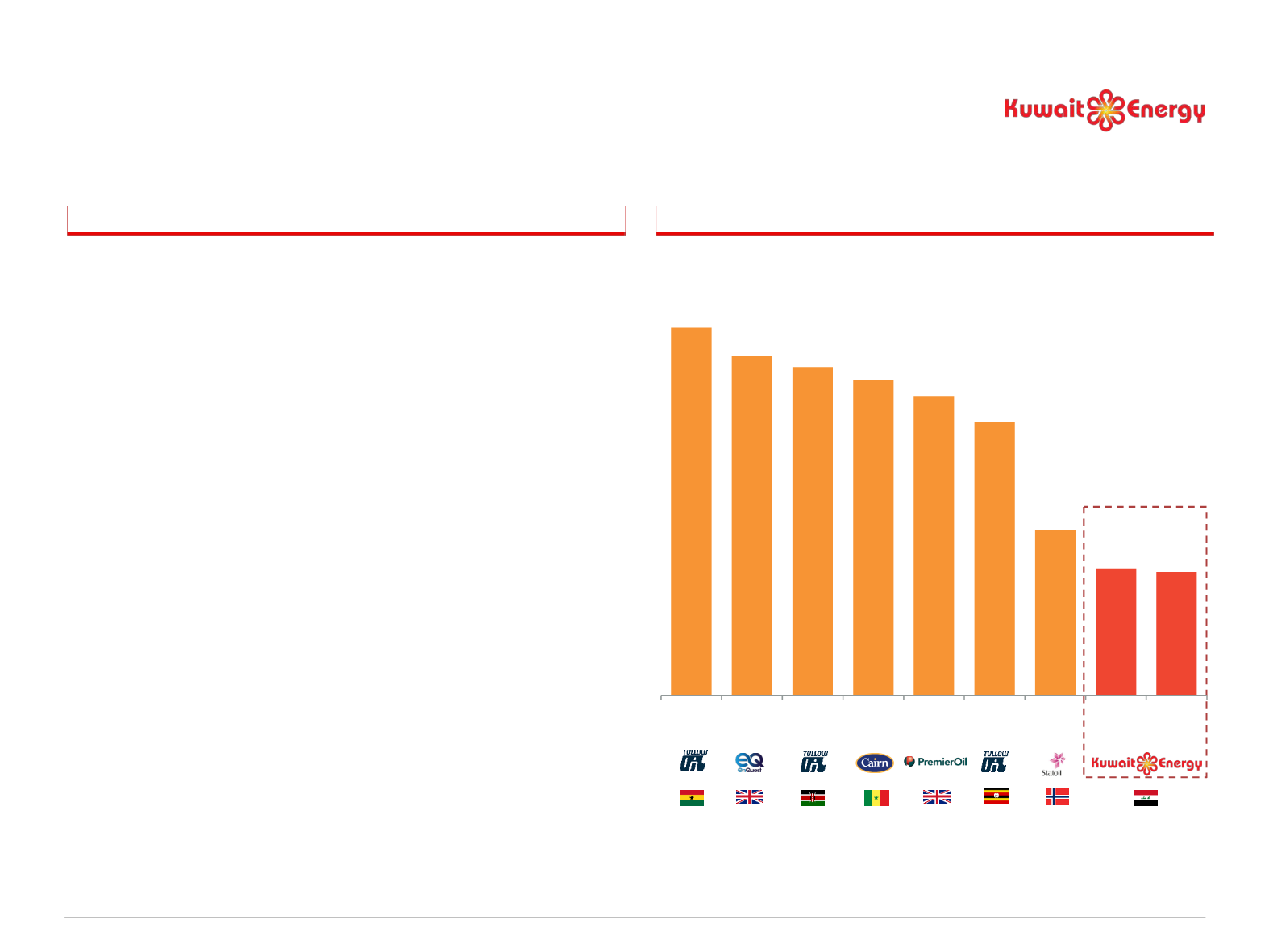

Key Elements of Financial Policy

Breakeven Brent Price ($/bbl)

(1)

Source: Company filing.

(1) Peers’ breakeven costs based on Wood Mackenzie to achieve a 10% IRR; Block 9 and Siba breakeven costs to achieve 10% IRR based on Kuwait Energy company model; assumed 10% WACC.

(2) Farm-out completion subject to pre-emption rights and government approvals.

Funding policy aimed at ensuring that sufficient

facilities are available to support business plan

A 3-year plan and 12-month budgeting

process allows Kuwait Energy to regularly

assess cash needs

Investment opportunities evaluated on based on

NPV, investment efficiency and payback period

Targeting primarily operated assets, allowing

control of pace and quantum of spending

Active portfolio management to optimise cash flows

Sale of 10% interest in Block 9 in 2015

Sale of 15% revenue WI / 20% cost WI in Siba

in 2016

(2)

Sale of 25% interest in Abu Sennan in 2016

(2)

Selected Dev’t Projects Globally

64

59

57

55

52

48

29

22 22

TEN Kraken South

Lokichar

SNE Catcher Lake

Albert

Johan

Sverdrup

Siba Block 9

Prudent Financial Policy and Risk

Management

Operator

Country

Ghana UK

Kenya

UK Uganda

Iraq

Norway

Senegal

24