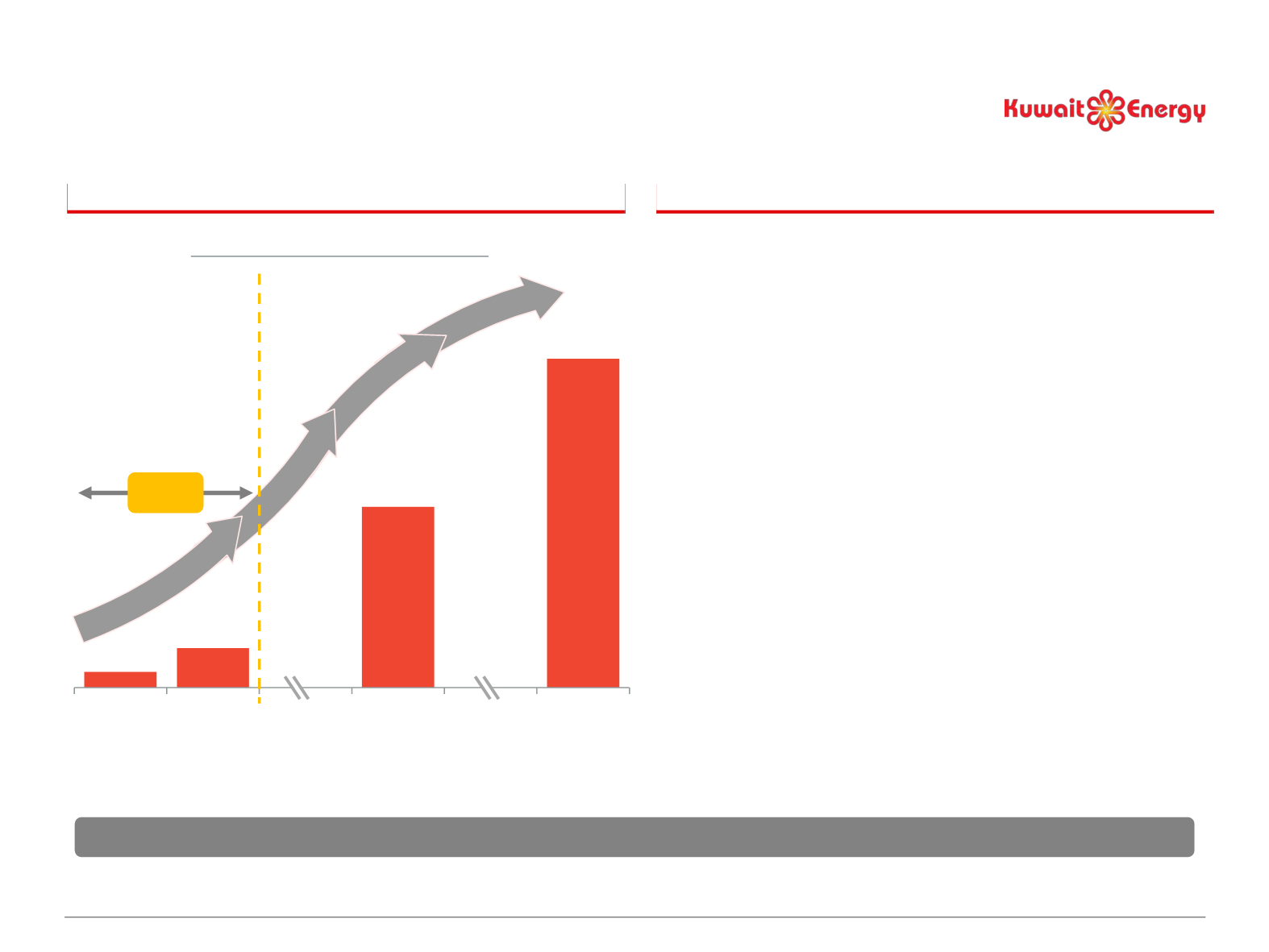

11.8

c.30

125 – 150

250+

2016

Exit

2018

Exit

2022 - 23

2025+

Early Production Program

(3)

Two wells on production currently, oil trucked to Bin

Umar station (42 km) – 90 kbbl/d capacity

One additional well (Faihaa-3) completed and

production target to start in mid February 2017

Two additional wells planned in 2017 and one in 2018

Gross production of c.30 kboe/d targeted by 2018 YE

(2)

Full Field Development

Kuwait Energy is planning to submit a full field

development plan (FDP) in 2019

(4)

Production increases thereafter, with 125+ kboe/d

targeted by 2022 and 250+ kboe/d by 2025

(1)

Optionality to monetise part of stake post FDP

(5)

Processing and Evacuation

Separate processing facilities to be constructed for

Yamama and Mishrif with planned total capacity of 155

kbbl/d

Separate export pipelines for Yamama and Mishrif

crudes to Al Fao depot (140 km)

Production Potential

(1)(2)

Field Development Plan

Block 9: Development Plan

Early prod’n

program

Full FDP

2019

10 year

plateau

Gross Production (kboe/d)

6 wells

Source: GCA report as at 31 December 2016.

(1) Production forecast based on management’s best estimates in the early phase of the field development; key assumptions include: a) recovery factor of 20% and 35% for the Mishrif and Yamama reservoirs,

respectively; b) potential implementation of water and/or gas injection projects; c) conversion of 2C resources. (2) Company estimate based on the assumption of 5 kbbl/d per well and a six-well development program

by 2018 year end. (3) Currently scheduled to expire at the end of 2018. (4) If approved, a 20 year development licence would be granted. (5) Subject to pre-emption rights and approvals.

Based on

2P Reserves

Based on

2P reserves &

2C resources

(1)

Targeting gross production rate of 250,000 boe/d by 2025

(1)

(2)

16