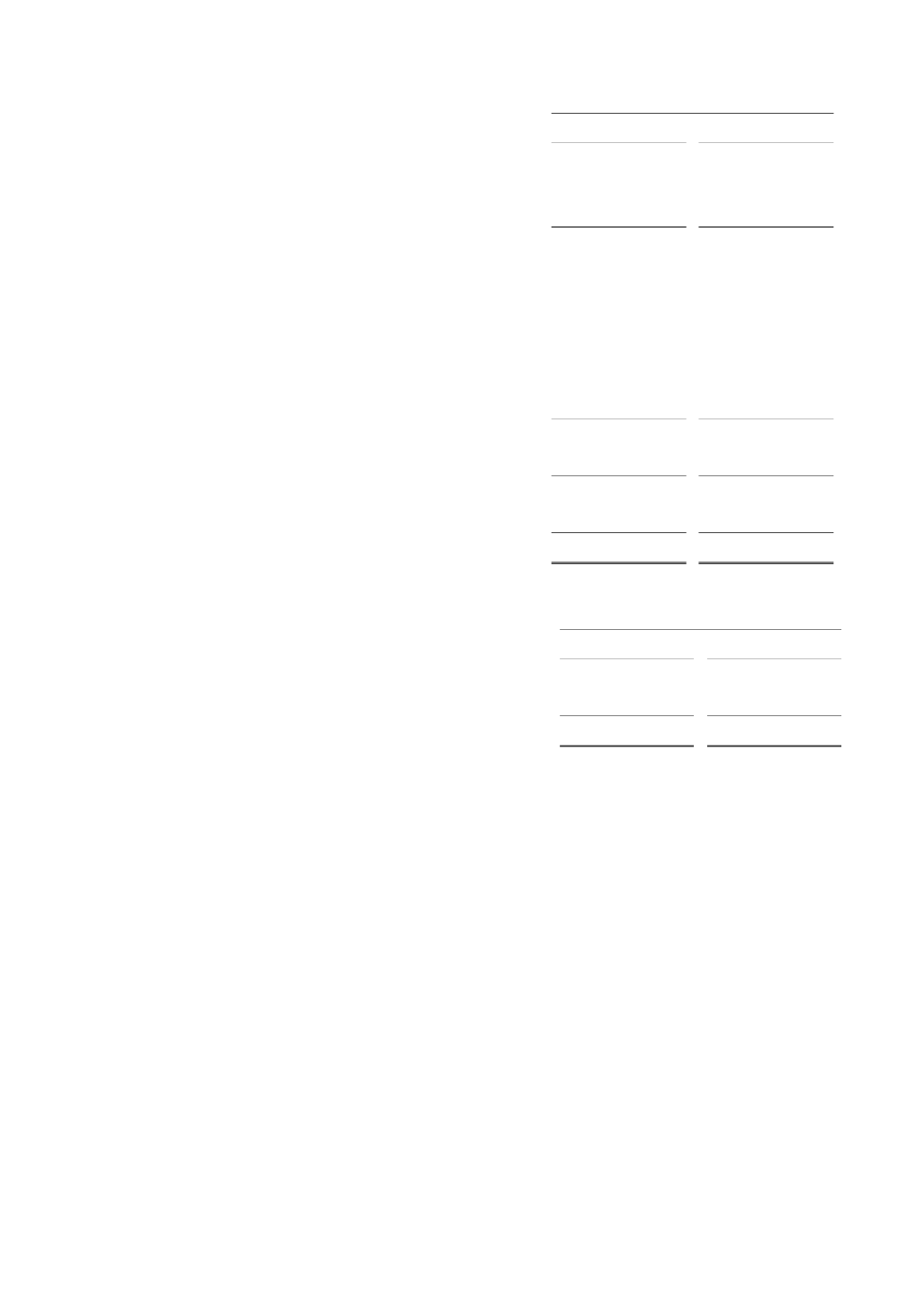

75

Year ended 31 December

($ thousands)

2011

2012

Gross profit

.................................................................................

83,754

103,932

Exploration expenditure written off...............................................

-

(3,680)

General and administrative expenses ............................................

(17,903)

(20,791)

Operating profit

..........................................................................

65,851

79,461

Net result from joint venture .........................................................

1,119

3,052

(Loss)/gain on held for trading derivative .....................................

(75)

266

Fair value loss on convertible loans...............................................

-

(4,528)

Other income ................................................................................

384

223

Foreign exchange gain ...................................................................

683

320

Finance costs (net) ........................................................................

(7,508)

(1,157)

Profit before tax

..........................................................................

60,454

77,637

Taxation charge .............................................................................

(8,731)

(8,272)

Profit for the period from continuing operations

.....................

51,723

69,365

Loss for the year from discontinued operations .............................

(16,960)

(24,401)

Profit for the year

.......................................................................

34,763

44,964

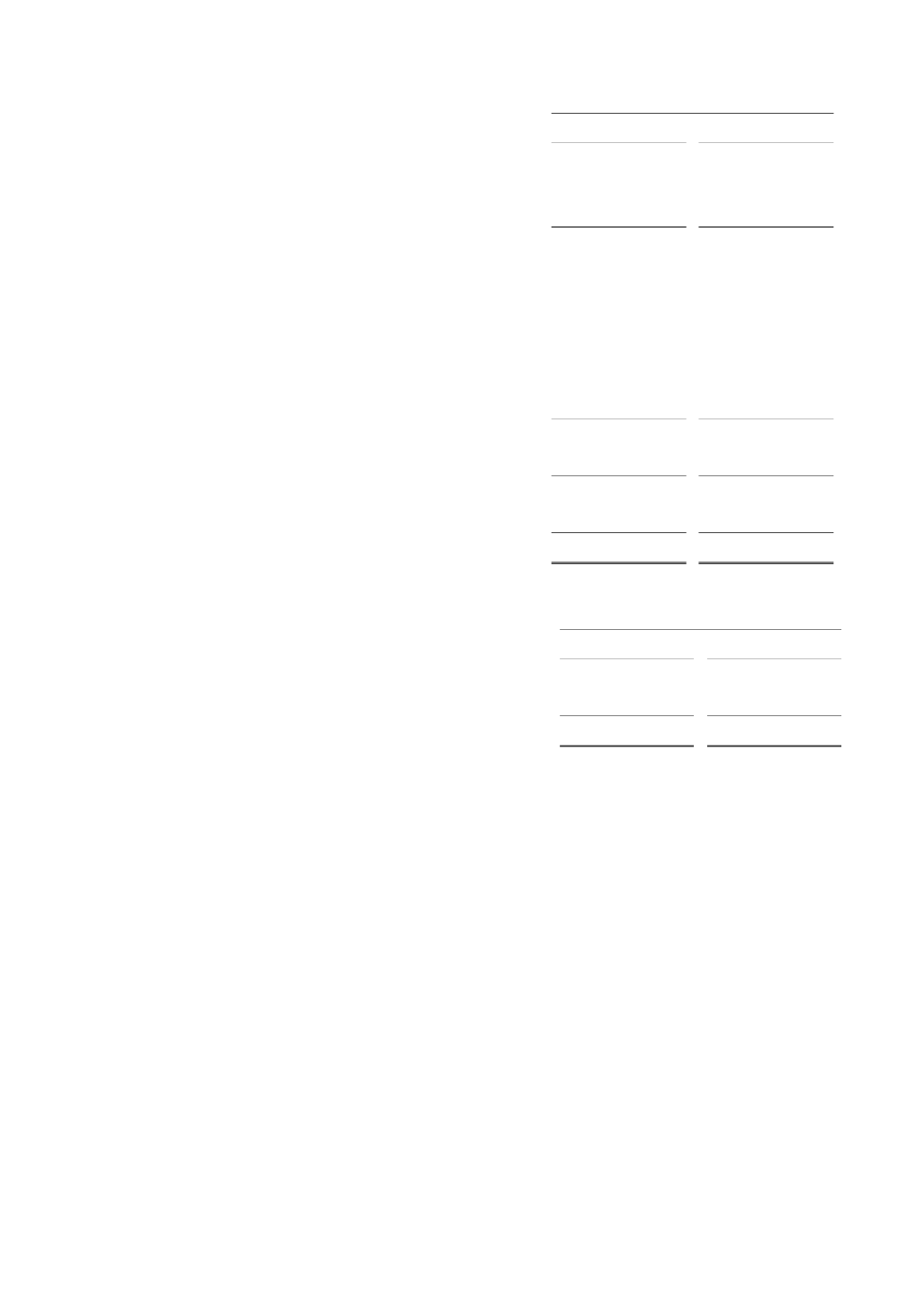

On a jurisdiction-by-jurisdiction basis, the Group’s revenue in 2011 as compared to 2012 is presented in the table below.

Year ended 31 December

($ thousands)

2011

2012

Egypt .............................................................................................

120,245

168,241

Yemen ...........................................................................................

18,273

14,735

Group revenue

.............................................................................

138,518

182,976

Revenue

Revenue increased by $44.5 million, or 32.1%, from $138.5 million in 2011 to $183.0 million in 2012. All of Group

revenues in both periods were from the sale of oil. The increase in total Group revenues was primarily attributable to

significantly higher working interest production volumes as the Group achieved average daily working interest

production (excluding Oman, for which production is not included in Group revenue) of 13,673 boepd in 2012, an

increase of 49.2% compared to 9,165 boepd in 2011. The Group’s higher working interest production was mainly from

increased production from ERQ and Burg El Arab and the commencement of production from Abu Sennan in Egypt, as a

result of drilling new wells and successful workovers, as well as slightly higher production in Oman. Partly offsetting the

increase in working interest production and revenues was a decrease in Block 43 in Yemen resulting from a decline in

production from existing wells.

Average realised sales prices were $107.4 per boe in 2012, an increase of 1.9% compared to $105.4 in 2011, further

contributing to the Group’s increased revenue.

Cost of sales

Cost of sales increased by $24.2 million, or 44.2%, from $54.8 million in 2011 to $79.0 million in 2012. This increase

was primarily attributable to higher recognised depletion expense of $46.7 million in 2012 compared to $28.1 million in

2011, resulting from the increase in the Group’s working interest production, as described above. Also contributing to

higher cost of sales in 2012 was an increase in operating costs, from $26.7 million in 2011 to $32.3 million in 2012, as a

result of the significant increase in the Group’s working interest production volumes in various assets in 2012, partly

offset by slightly lower operating expenses in Block 43 in Yemen due to lower production, as well as operating expense

reductions across the Group.