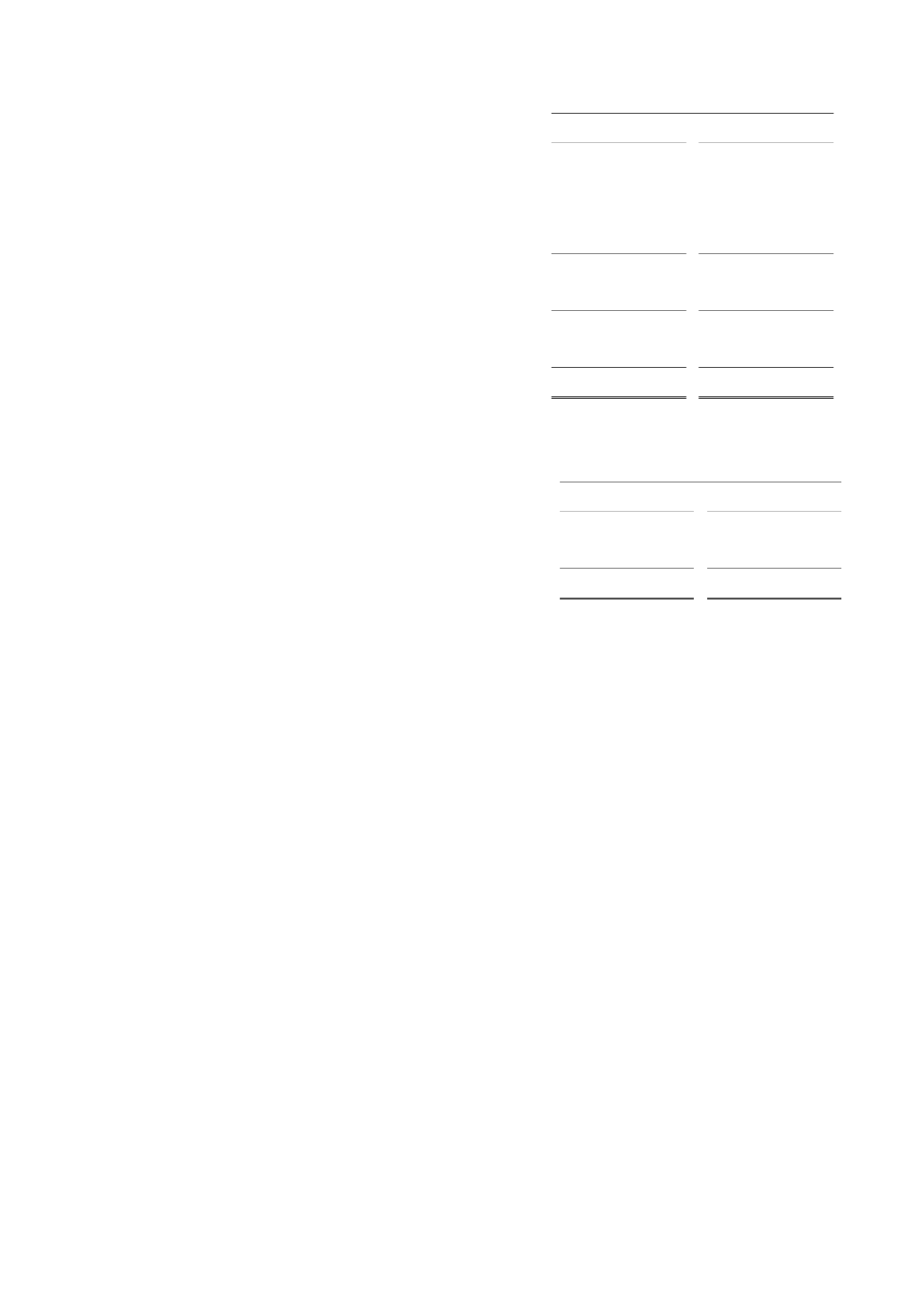

73

Year ended 31 December

($ thousands)

2012

2013

Fair value loss on convertible loans ..............................................

(4,528)

(12,071)

Other income ................................................................................

223

599

Foreign exchange gain/(loss) ........................................................

320

(3,762)

Finance costs (net) ........................................................................

(1,157)

(10,068)

Profit before tax

..........................................................................

77,637

28,254

Taxation charge .............................................................................

(8,272)

(8,097)

Profit for the period from continuing operations

.....................

69,365

20,157

Loss for the year from discontinued operations.............................

(24,401)

(278,787)

Profit/(loss) for the year

.............................................................

44,964

(258,630)

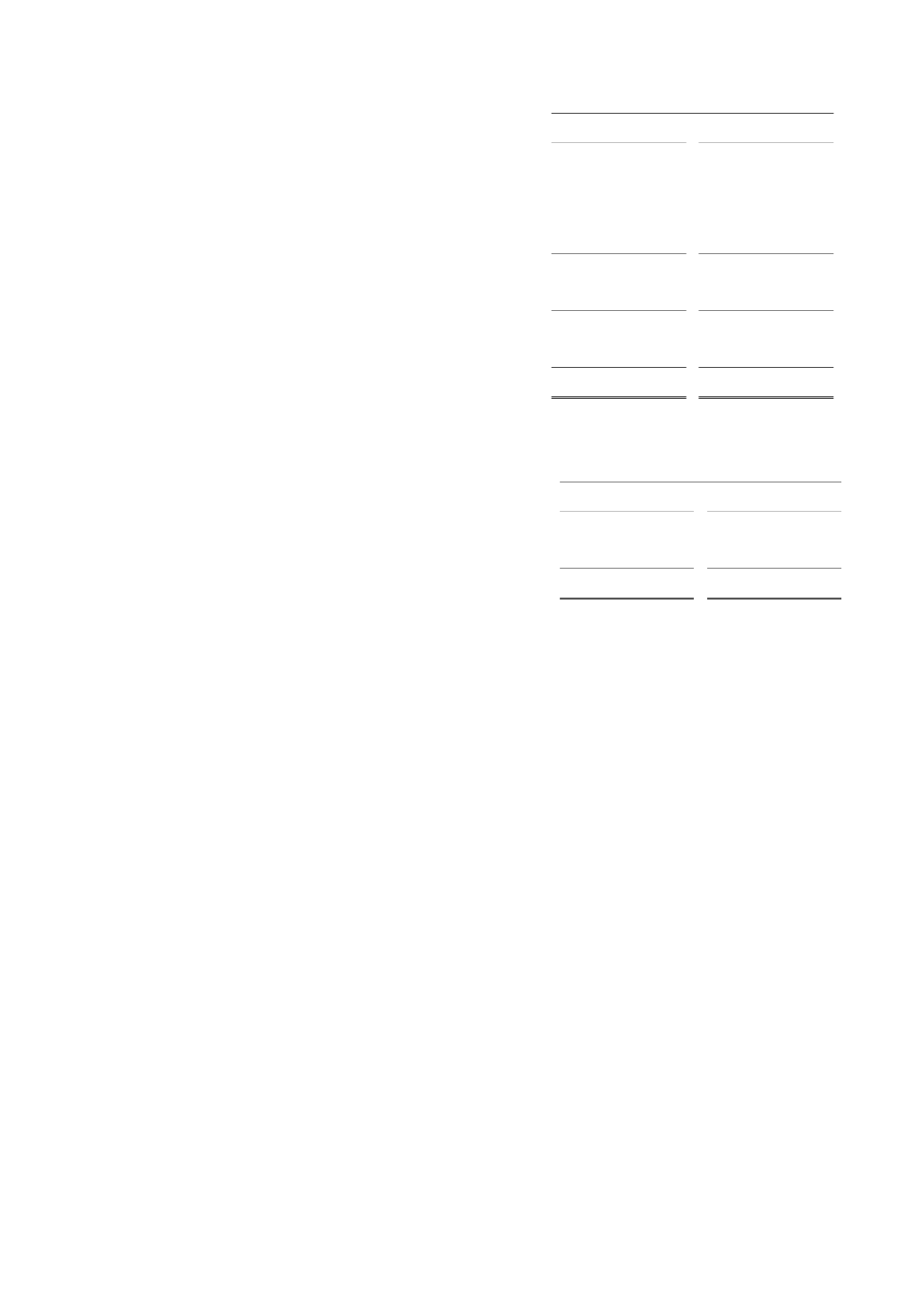

On a jurisdiction-by-jurisdiction basis, the Group’s revenue in 2012 as compared to 2013 is presented in the table below.

Year ended 31 December

($ thousands)

2012

2013

Egypt .............................................................................................

168,241

193,487

Yemen ...........................................................................................

14,735

69,007

Group revenue

.............................................................................

182,976

262,494

Revenue

Revenue increased by $79.5 million, or 43.4%, from $183.0 million in 2012 to $262.5 million in 2013. All Group

revenues in both periods were from the sale of oil. The increase in total Group revenues was primarily attributable to

significantly higher working interest production volumes as the Group achieved average daily working interest

production (excluding Oman, for which production is not included in Group revenue) of 19,270 boepd in 2013, an

increase of 40.9% compared to 13,673 boepd in 2012. The Group’s increased working interest production was mainly

from the inclusion of eleven months of production from Block 5 in Yemen as well as increased production from ERQ

and Abu Sennan in Egypt as a result of drilling new wells and successful workovers. Partly offsetting the increase in

working interest production and revenues was a slight natural decline in production from the BEA field in Egypt.

Average realised sales prices were $105.5 per boe in 2013, an decrease of 1.8% compared to $107.4 in 2012, further

contributing to the offset of the Group’s increased revenue.

Cost of sales

Cost of sales increased by $55.9 million, or 70.7%, from $79.0 million in 2012 to $134.9 million in 2013. This increase

was primarily attributable to significantly higher depletion expenses and operating costs in 2013, as a result of the

significant increase in the Group’s working interest production volumes. The acquisition of Block 5 in Yemen in

February 2013 contributed $48.8 million of the increase in cost of sales in 2013. This increase was primarily attributable

to higher recognised depletion expense of $80.7 million in 2013 compared to $46.7 million in 2012, resulting from the

increase in the Group’s production, as described above. The Group’s 2P reserves declined slightly in 2013 as compared

to 2012, primarily due to continued production accompanied by delays in the commencement of production in

Mansuriya, which were partly offset by positive outcomes in the Shahd-3 and Shahd SE-6 development wells in ERQ in

Egypt, and revisions in the production schedule and an increase in assumed productivity of development wells in Siba in

Iraq. As a result of the decrease in the Group’s 2P reserves in 2013 as compared to 2012, its previously capitalised

exploration, appraisal and development costs were spread over a lower level of reserves in 2013, increasing these

depletion costs. Also contributing to higher cost of sales in 2013 was an increase in operating costs, from $32.3 million

in 2012 to $54.2 million in 2013, as a result of the significant increase in the Group’s working interest production

volumes in 2013, particularly in Block 5 in Yemen.

Impairment (loss)/reversal

Impairment losses were $1.8 million in 2013, compared to $nil in 2012. These losses were due to the recognition of