3

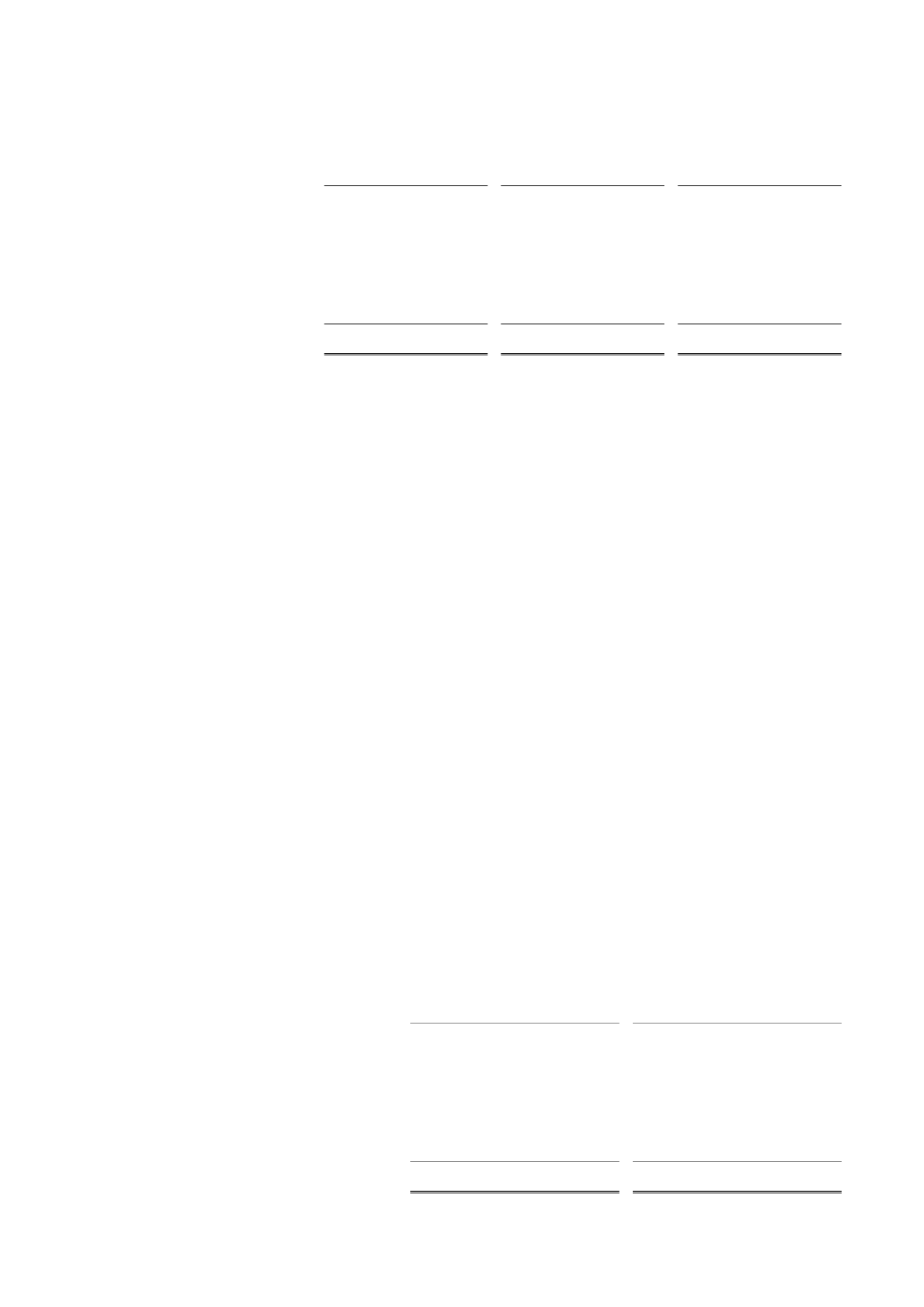

Proved Reserves (1P)

Net Entitlement Basis

(1)

Total

Proved + Probable

Reserves (2P) Net

Entitlement Basis

(1)

2C Contingent

Resources Working

Interest Basis

(2)

mmboe

(3)

Location

Egypt..............................................

3.3

10.3

10.4

Iraq

(4)

..............................................

22.1

25.3

820.4

Yemen............................................

1.4

1.7

19.1

Total

(5)(6)(7)

.....................................

26.8

37.0

850.0

(1)

Group 1P and 2P reserves in these columns are presented on a “net entitlement” basis, and present reserves estimated to be attributable to

the Group based on its contractual working interest in the costs, benefits and ownership of a particular asset, including cost recovery and

profit share amounts, and reduced by royalties or share of production owing to others under applicable lease and fiscal terms, as adjusted for

any corporation tax paid on their behalf and in kind. In assets governed by a PSC or a service contract (as opposed to assets under a

tax/royalty fiscal regime), the Group’s net entitlement reserves are calculated in accordance with the terms of the PSC or service contract on

the basis of forecast price and cost assumptions as evaluated in reports prepared by GCA.

(2)

Group 2C Contingent Resources in this column are presented on a “working interest” basis and are therefore not directly comparable with

the reserves presented as net entitlement volumes. Group working interest resources are the Group’s revenue working interest fraction of the

gross resources of a given field. In assets governed by a PSC or a service contract (as opposed to assets under a tax/royalty fiscal regime),

Group net entitlement volumes under the terms of the PSC or service contract can be expected to be less than working interest volumes.

(3)

Gas and condensate volumes have been converted by the Group to oil equivalent volumes using conversion factors of 6.0 mscf/boe and 1.0

bbl/boe respectively.

(4)

The Group is currently seeking opportunities to sell its interest in its Mansuriya asset in Iraq or otherwise exit the asset and intends to spend

only the minimum capital expenditures required under the Mansuriya licence. According to GCA’s report, as at 31 May 2014, of the

volumes presented in the table, Mansuriya represented 47.5 mmboe of 1P reserves on a revenue working interest basis, 72.9 mmboe of 2P

reserves on a revenue working interest basis, 14.4 mmboe of 1P reserves on a net entitlement basis, 15.7 mmboe of 2P reserves on a net

entitlement basis and 6.3 mmboe of 2C contingent resources on a revenue working interest basis. The Group is engaged in active

negotiations to farm out a portion of its working interest share in the Block 9 licence and expects to conclude an arrangement by the end of

2014. If such a farm out arrangement is entered into, the proportion of the Block 9 contingent resources in the CPR that are attributable to

the Group will be reduced accordingly. See “

Risk Factors—Risks relating to the Group—The economic valuations contained in the CPR

may not provide an accurate estimate of the value of the Group or its assets

.”

(5)

Excludes Oman due to the fact that activities in the Karim Small Fields are carried out pursuant to a service agreement, the terms of which

do not allow external reporting of reserves volumes.

(6)

Sum totals may differ from sums of line items presented as a result of rounding.

(7)

Contingent resources should not be aggregated with reserves because of the different levels of risk involved.

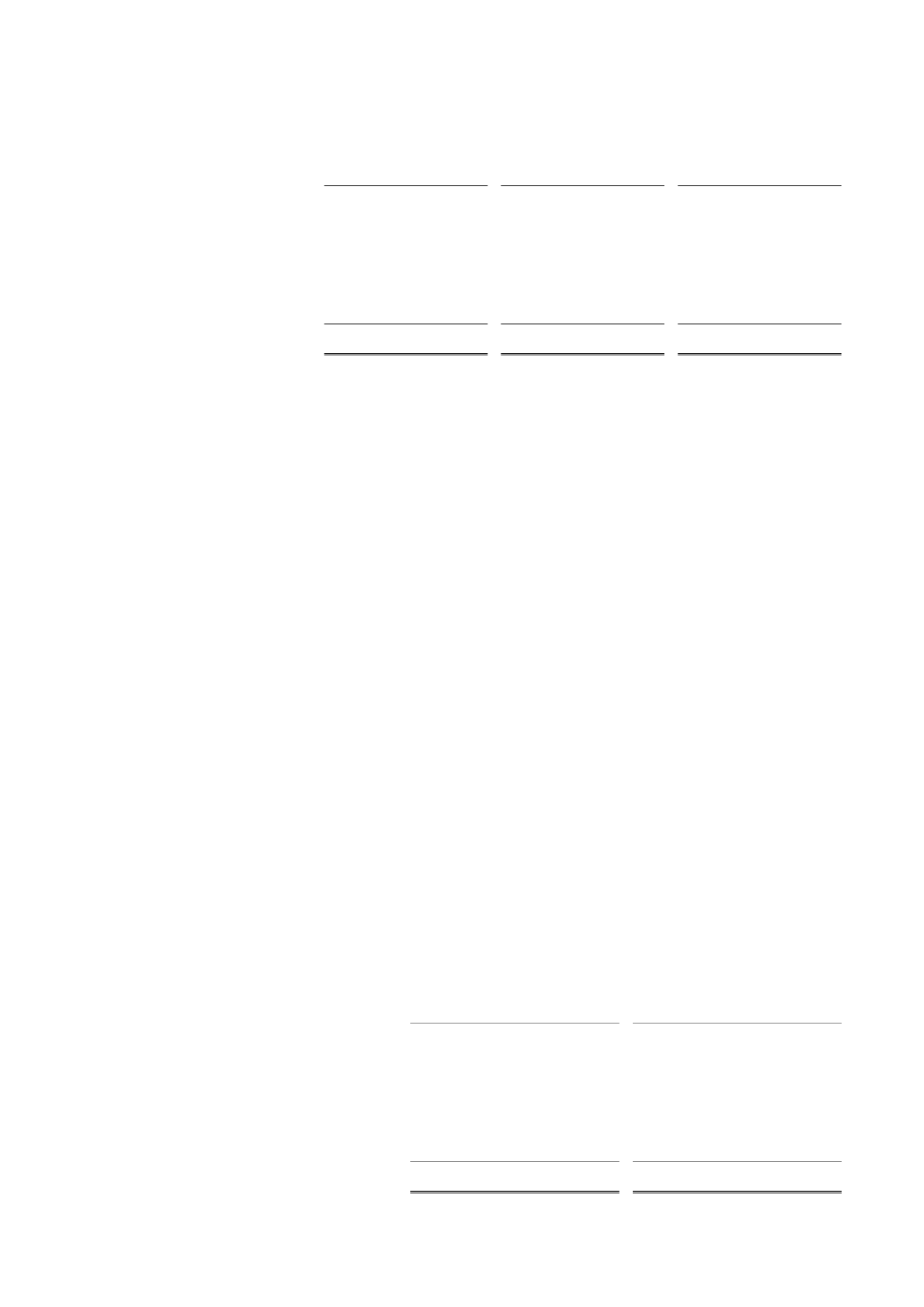

Set out below is a table summarising, as at 31 May 2014, estimates of the Group’s oil and gas reserves presented on a

working interest basis. These estimates are derived from the “

Competent Person’s Report

.” For explanations of the

terms, see “

Presentation of financial and other information—Reserves and Resources Reporting—Basis of Preparation

.”

Proved Reserves (1P)

Working Interest Basis

(1)

Total

Proved + Probable Reserves

(2P) Working Interest Basis

(1)

mmboe

(2)

Location

Egypt..................................................................

8.6

27.9

Iraq

(3)

..................................................................

77.3

132.5

Yemen................................................................

4.2

5.3

Total

(4)(5)

............................................................

90.2

165.7