25

24

Financial Performance

Kuwait Energy reported record annual results in sales revenue and net profit for 2014.

2014 fnancial highlights:

• Record sales revenue of US$ 270.8 million, up 3% from 2013.

• Record net profit of US$ 42.7 million.

• Operating cash flow of US$ 182.1 million, down 5% from 2013, primarily due to oil price.

• Issued US$ 250 million senior guaranteed notes.

• Credit rating of B- by Fitch and Standards & Poor’s.

In 2014, Kuwait Energy delivered record sales revenue of US$ 270.8 million, 3% higher than 2013 as a result

of increased production in all of the Group’s Egyptian assets and offset partly by a decrease in average

realised price of the product. This resulted in a record net profit after tax of US$ 42.7 million for 2014, a

significant turnaround from 2013 when the Eurasia assets were ‘held for sale’ with an overall net loss of

US$ 295.8 million.

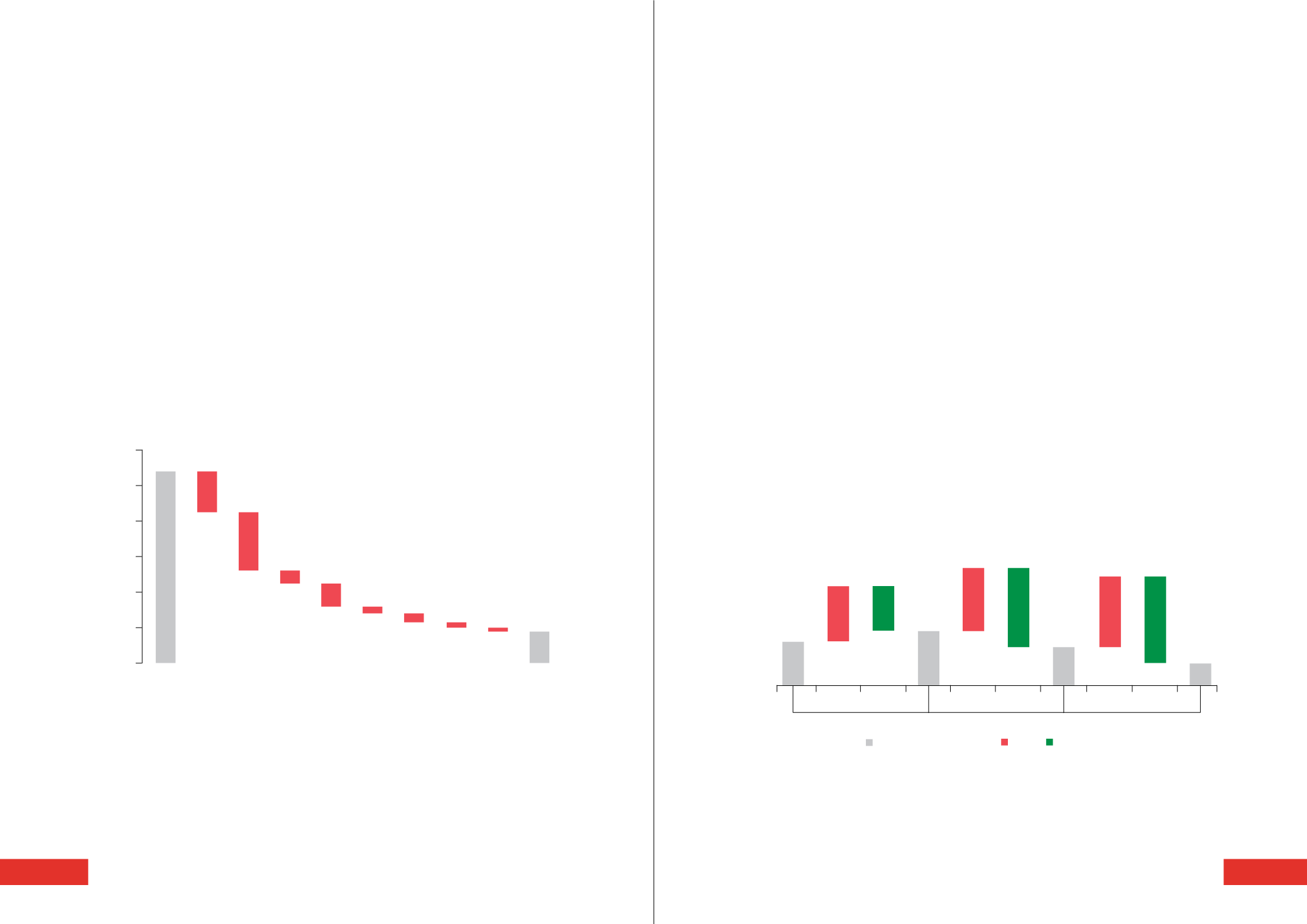

Net Profit Contributors 2014

Revenue

Opex

Depletion

Impairment

G&A

FV Convertible

Finance Costs

Taxation

Others

Net Income

0

50

100

150

200

250

300

US$ Million

270.8 57.4

81.9

19.2

32.7

9.9

8.8 5.4 42.7

12.8

Others include exploration expenditure written off, loss for the year from discontinued operations, foreign

exchange loss offset by other income, share in results of joint venture and movement in stock. In per barrel

of oil terms, the revenue equated to 95.5 US$ /boe with operating costs of 7.3 US$ /bbl and G&A costs of

4.2US$ /boe.

An impairment charge of US$ 19.2 million arose due to the steep fall in oil prices in the second half of 2014

and relates to Block 5 license in Yemen. Operations at Block 5 continued but were sometimes disrupted

during 2014 due to tribal and regional unrest. We continue to take steps to protect our license interest, as

described further in note 14 and 33 of the consolidated financial statements.

During 2014, Kuwait Energy has voluntarily changed its accounting policy for oil and gas exploration and

evaluation expenditure from the ‘modified full cost method’ to the ‘successful efforts method’ to better

reflect the performance of the Group and to align with the more prevalent method of accounting for oil

and gas assets within its peer group. Prior years’ accounts have been restated based on the ‘successful

efforts method’.

Kuwait Energy generated an operating cash flow before working capital movements of US$ 182.1 million

in 2014 with US$ 216.0 million in cash and cash equivalents as at 31 December 2014. In August 2014,

the Group issued US$ 250 million aggregate principal amount of its 9.5% senior guaranteed notes ("The

Notes") listed on the Irish Stock Exchange due in 2019. Part of the proceeds of the Notes has been used

to repay in full the amounts outstanding under the Reserve Based Facilities and the Arab Bank Facility.

Remaining proceeds, after fees, are being used to fund capital expenditure of the Group, particularly in

respect of its assets in Iraq and for general corporate purposes.

In 2014, Kuwait Energy total capital expenditure was US$ 266.1 million, which was primarily spent on the

Siba gas plant construction and the drilling of 48 development and appraisal wells, and six exploration

wells. Kuwait Energy continued to focus on collecting money owed by its major customer in Egypt, EGPC,

as evidenced by the significant amounts collected during the year 2014 of US$ 263.2 million.

The chart below presents movements in Kuwait Energy’s receivables from EGPC from 2012 to 2014.

EGPC Sales And Receipt 2012 to 2014

2012

2013

2014

131.4

167.1 134.7

163.8

193.5 241.5

213.6 263.2

66.2

115.8

Outstanding Receivables Sales EGPC Payments

US$ Million