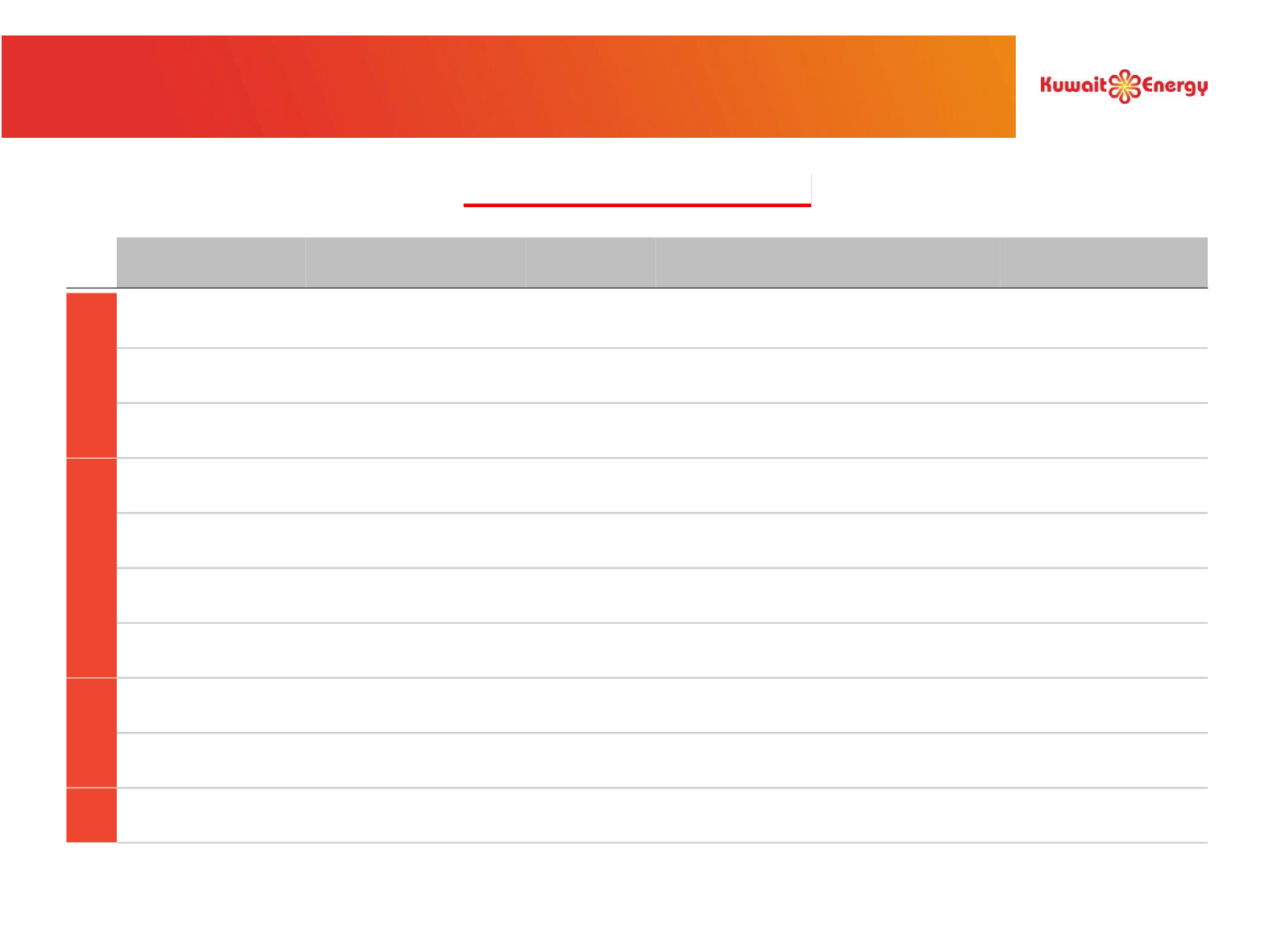

Detailed Ownership by Asset

Asset

KE

Operator

Revenue

WI

(1)(2)

Cost WI

(1)

Partners

Licence Expiry

Iraq

Block 9

(3)

✓

60.00% 60.00%

Dragon Oil 30%, EGPC 10%

-

(5)

Siba

✓

30.00% 40.00%

TPAO 30%, Missan Oil Company 25%,

EGPC 15%

2032

Mansuriya

22.50% 30.00% TPAO* 37.5%, OEC 25%, KOGAS 15%

2031

Egypt

Abu Sennan

✓

25.00% 53.00%

Dover 28%, Rockhopper 22%, Global

Connect 25%

2032 - 2036

Burg El Arab (BEA)

✓

100.00% 100.00%

-

2021

Area A

✓

70.00% 70.00%

Petrogas 30%

2019 - 2023

East Ras Qattara

(ERQ)

49.50% 49.50%

ENAP Sipetrol* 50.5%

2027 – 2031

Yemen

Block 5

✓

15.00% 15.00%

YICOM 20%, KUFPEC 20%; Newco 15%

(4)

,

Total 15%, ExxonMobil 15%

2018

(6)

Block 49

✓

64.00% 75.29%

Consolidated Contractors Company 21%,

TYC 15%

-

(5)

Oman

Karim Small Fields

(KSF)

15.00% 15.00%

Medco Energy* 51%, Oman Oil Company

25%, Vision Oil 5%, Petrovest 4%

2040

(1) Source: GCA report as at 31 December 2016. * Denotes operatorship.

(2) Revenue WI is the percentage interest of Kuwait Energy in the revenues derived from sale of production from an asset, before taking into account any taxes, fees, royalties or other payments.

(3) Kuwait Energy is currently engaged in a dispute under which the claimant asserts that it has a right to an increased non-controlling share. Kuwait Energy believes that the claimant’s position will not be vindicated,

and Kuwait Energy is firmly committed to vigorously rebutting the claim. (4) Newco was formed by two Russian companies: Mashinoexport and Zarubezhgeologiya. (5) In Block 9 and Block 49, 20 year licences are

expected to be granted for each approved development area; each with a possible 5 year extension period. (6) A number of Force Majeure events have occurred hence licence for Block 5 will not expire before

March 2018; a 5 year extension of the licence is likely.

32

Asset Snapshot