KUWAIT ENERGY PLC

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

For the three month period ended 31 March 2017

11

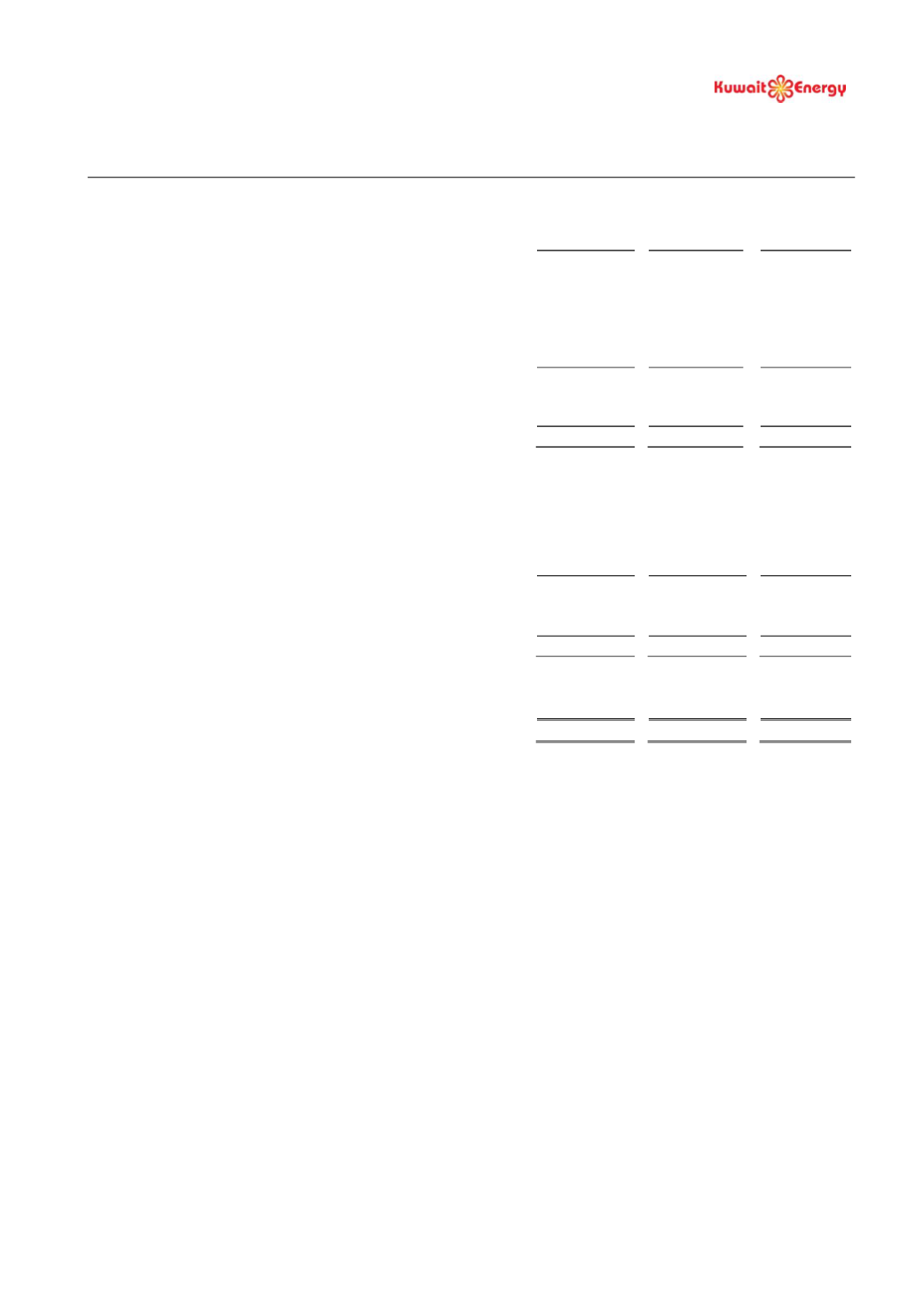

7.

PROPERTY PLANT AND EQUIPMENT

The additions to oil and gas assets mainly relate to Siba and Block 9 in Iraq, and include US$ 4.2 million (31 December

2016: US$ 17.0 million) of finance costs on qualifying assets capitalised during the period and US$ 0.4 million (31

December 2016: US$ 2.4 million) of fair value loss on convertible loans capitalised.

Additions of US$4.8 million were made in the period relating to the assets held for sales (see note 10).

Oil and

gas assets

Other fixed

assets

Total

Cost

US$ 000’s

US$ 000’s

US$ 000’s

As at 1 January 2016

1,067,280

23,661

1,090,941

Additions

160,957

142

161,099

Disposal

-

(622)

(622)

Transfer from Intangible exploration and evaluation assets

1,485

-

1,485

Transfer to assets held for sale

(194,962)

(103)

(195,065)

As at 31 December 2016

1,034,760

23,078

1,057,838

Additions

34,145

34

34,179

Disposal

-

(47)

(47)

As at 31 March 2017

1,068,905

23,065

1,091,970

Accumulated Depreciation, depletion, amortisation and impairment

As at 1 January 2016

459,657

9,713

469,370

Charge for the year

60,257

2,137

62,394

Impairment

94,337

-

94,337

Disposal

-

(562)

(562)

Transfer to assets held for sale

(77,070)

-

(77,070)

As at 31 December 2016

537,181

11,288

548,469

Charge for the period

13,830

452

14,282

Disposal

-

(47)

(47)

As at 31 March 2017

551,011

11,693

562,704

Carrying amount

As at 31 March 2017 (Unreviewed)

517,894

11,372

529,266

As at 31 December 2016 (audited)

497,579

11,790

509,369