57

USE OF PROCEEDS

The net proceeds from the issuance of the Notes will amount to approximately $240.0 million.

The Group intends to use the net proceeds from the Offering to (i) to repay in full on or about the Issue Date amounts

outstanding under the Borrowing Base Facilities Agreement and the Arab Bank Facility Agreement (the “

Refinancing

”),

(ii) to partially fund capital expenditures as part of the Group’s exploration, appraisal and development programmes,

particularly in respect of the Group’s assets in Iraq and (iii) for general corporate purposes.

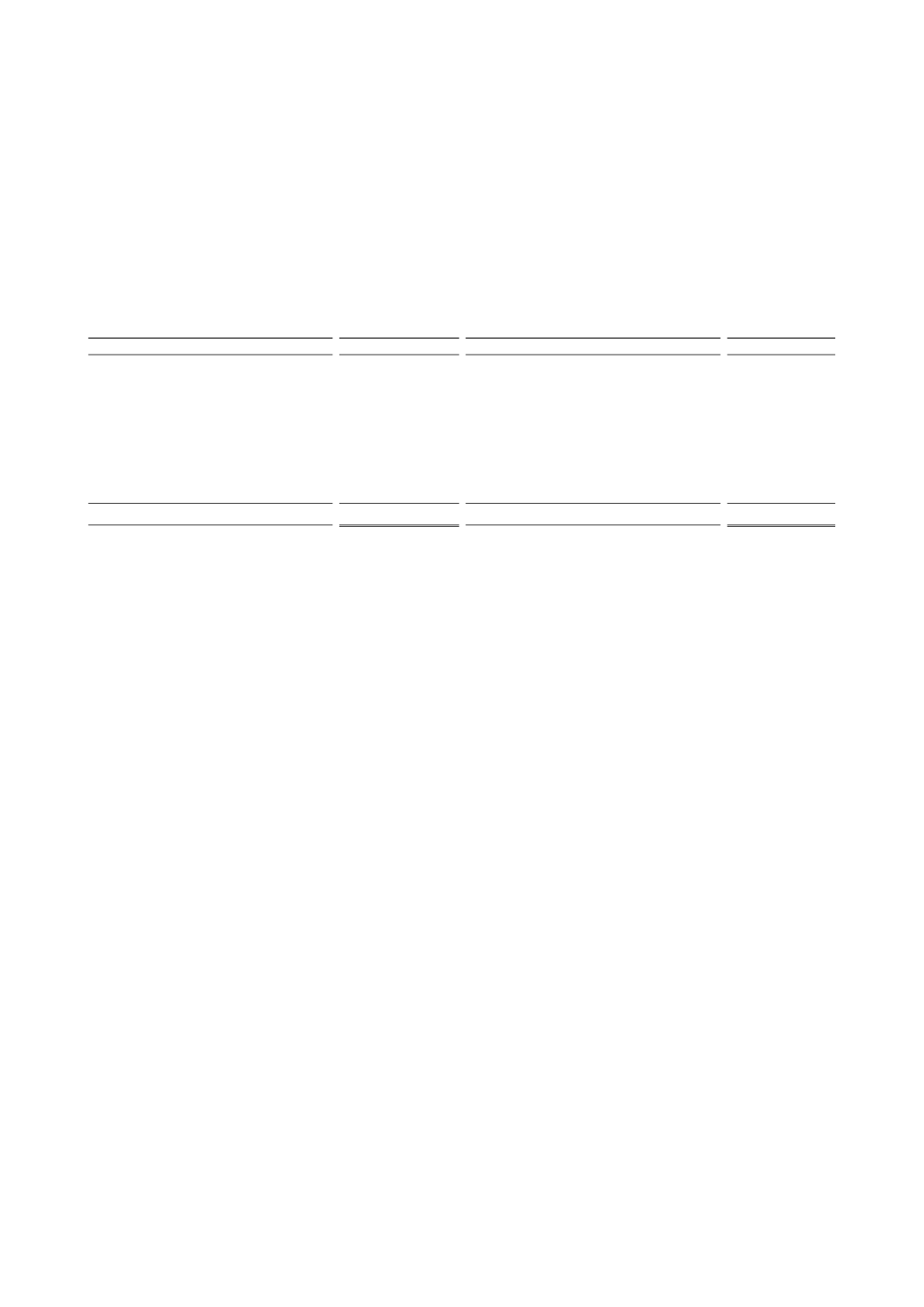

The following table sets forth the expected sources and uses of funds in connection with the Offering (all amounts shown

are principal amounts unless otherwise indicated). Actual amounts will vary from estimated amounts depending on

several factors including differences from the Group’s estimate of fees and expenses.

Sources

($ millions)

Uses

($ millions)

Notes offered hereby

(1)

.......................

250.0

Existing Borrowing Base Facilities

(2)

103.9

Existing Arab Bank Facility

(3)

..............

55.0

Additional liquidity and general

corporate purposes ................................

81.1

Estimated fees and expenses

(4)

..............

10.0

Total Sources ........................................

250.0

Total Uses ..............................................

250.0

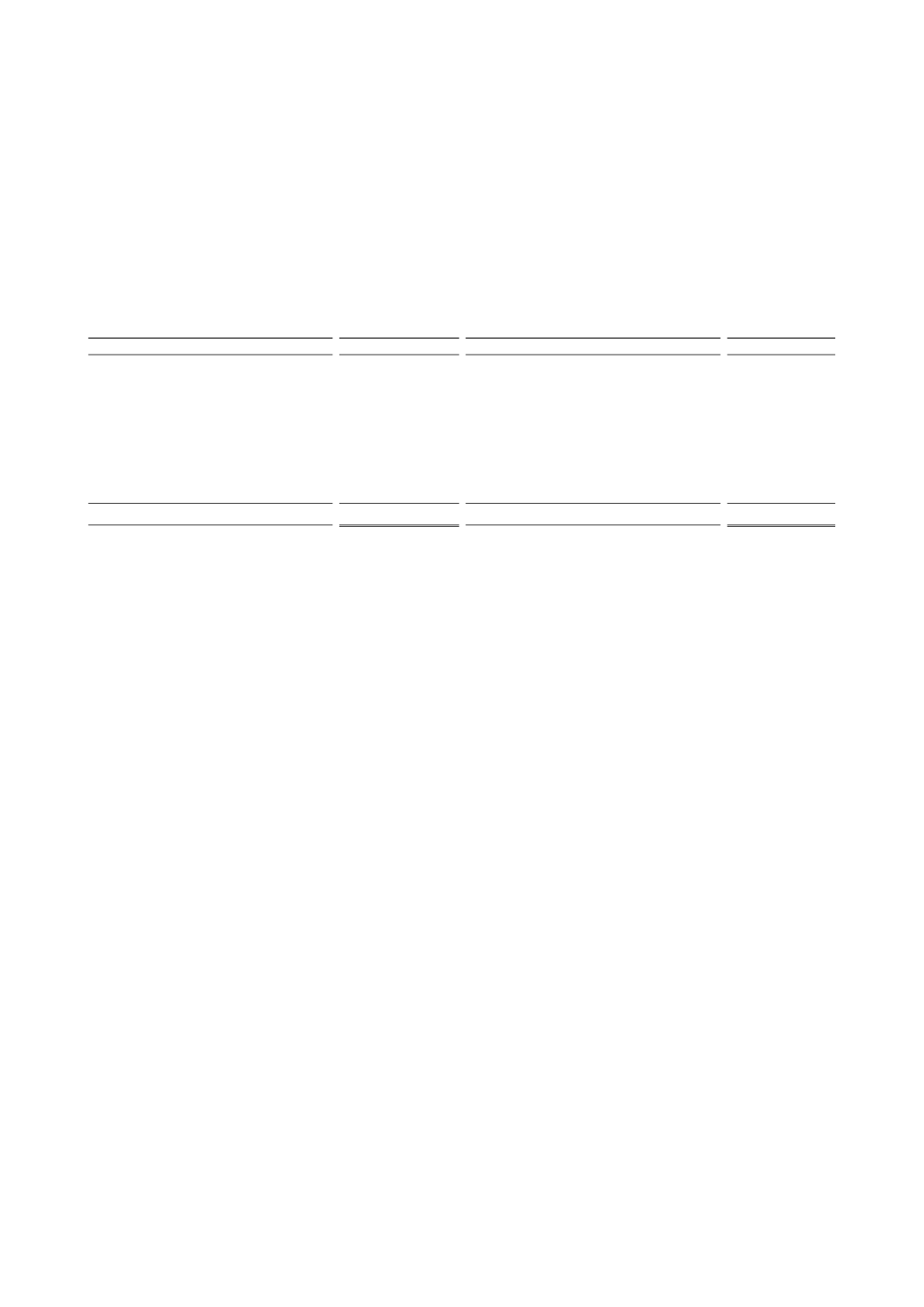

(1)

The amount reflects the gross proceeds from the issuance of the Notes.

(2)

Represents the amounts outstanding under the Borrowing Base Facilities Agreement as at 31 March 2014. As

part of the Refinancing, the outstanding indebtedness under the Borrowing Base Facilities Agreement will be

repaid in full (and terminated) on or about the Issue Date with the proceeds of the Offering, which amount

excludes accrued interest and break costs in connection with discharging the Borrowing Base Facilities

Agreement. The outstanding principal amount of indebtedness under the Borrowing Base Facilities Agreement

as at the date of this Offering Memorandum is $84.9 million, with an additional $20.5 million expected to be

drawn prior to the Issue Date, for a total of $105.4 million expected to be outstanding as at the Issue Date,

which amount excludes accrued interest and any break costs.

(3)

Represents the amount outstanding under the Arab Bank Facility Agreement as at 31 March 2014. As part of

the Refinancing, the outstanding indebtedness under the Arab Bank Facility Agreement will be repaid in full

(and terminated) on or about the Issue Date with the proceeds of the Offering, which amount excludes accrued

interest and break costs in connection with discharging the Arab Bank Facility Agreement. The outstanding

principal amount of indebtedness under the Arab Bank Facility Agreement as at the date of the Offering

Memorandum was $50.0 million, which amount excludes accrued interest and any break costs.

(4)

Represents estimated fees and expenses incurred in connection with the Refinancing including fees and

commissions, financial advisory costs, other transaction costs, break costs and professional fees.