KUWAIT ENERGY plc GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2013

F-70

29.

FINANCIAL INSTRUMENTS (CONTINUED)

Liquidity risk management (continued)

Ultimate responsibility for liquidity risk management rests with the management, which has built an appropriate

liquidity risk management framework for the management of the Group’s short, medium and long-term funding

and liquidity management requirements. The Group manages liquidity risk by maintaining adequate reserves and

banking facilities, by continuously monitoring forecast and actual cash flows and matching the maturity profiles

of financial assets and liabilities.

The following tables detail the Group’s remaining contractual maturity for its financial liabilities. The tables have

been drawn up based on the undiscounted cash flows of financial liabilities, including interest.

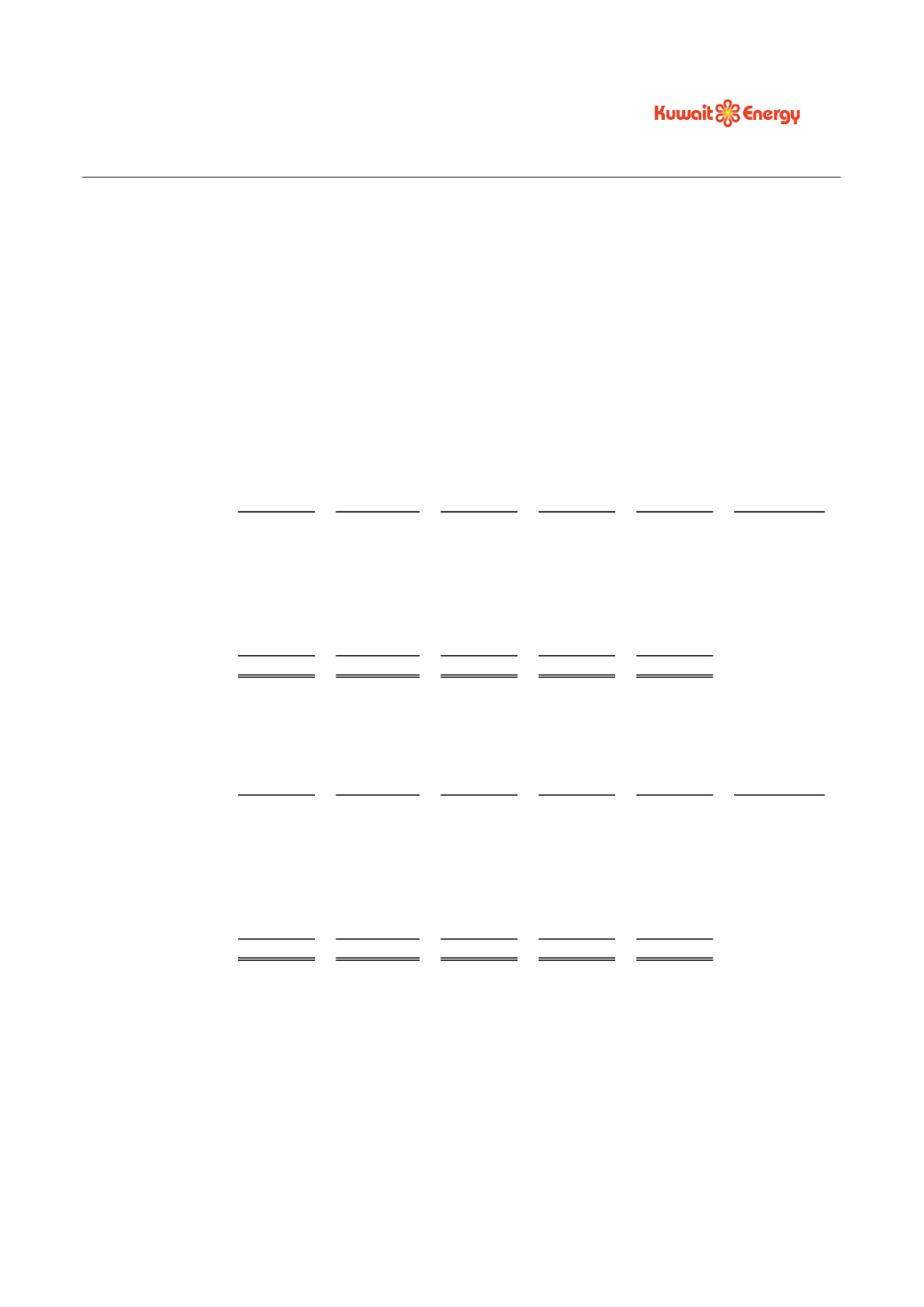

At 31 December 2013

Financial

liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More

than 5

years

Total

Weighted

average

effective

interest rate

USD

000’s

USD

000’s

USD

000’s

USD

000’s

USD

000’s

%

Long-term

loans

84,346

93,447

-

-

177,793

6.62%

Convertible

loans

8,000

16,000

96,796

17,169

137,965

16%

Trade and other

payables

93,617

-

-

-

93,617

185,963

109,447

96,796

17,169

409,375

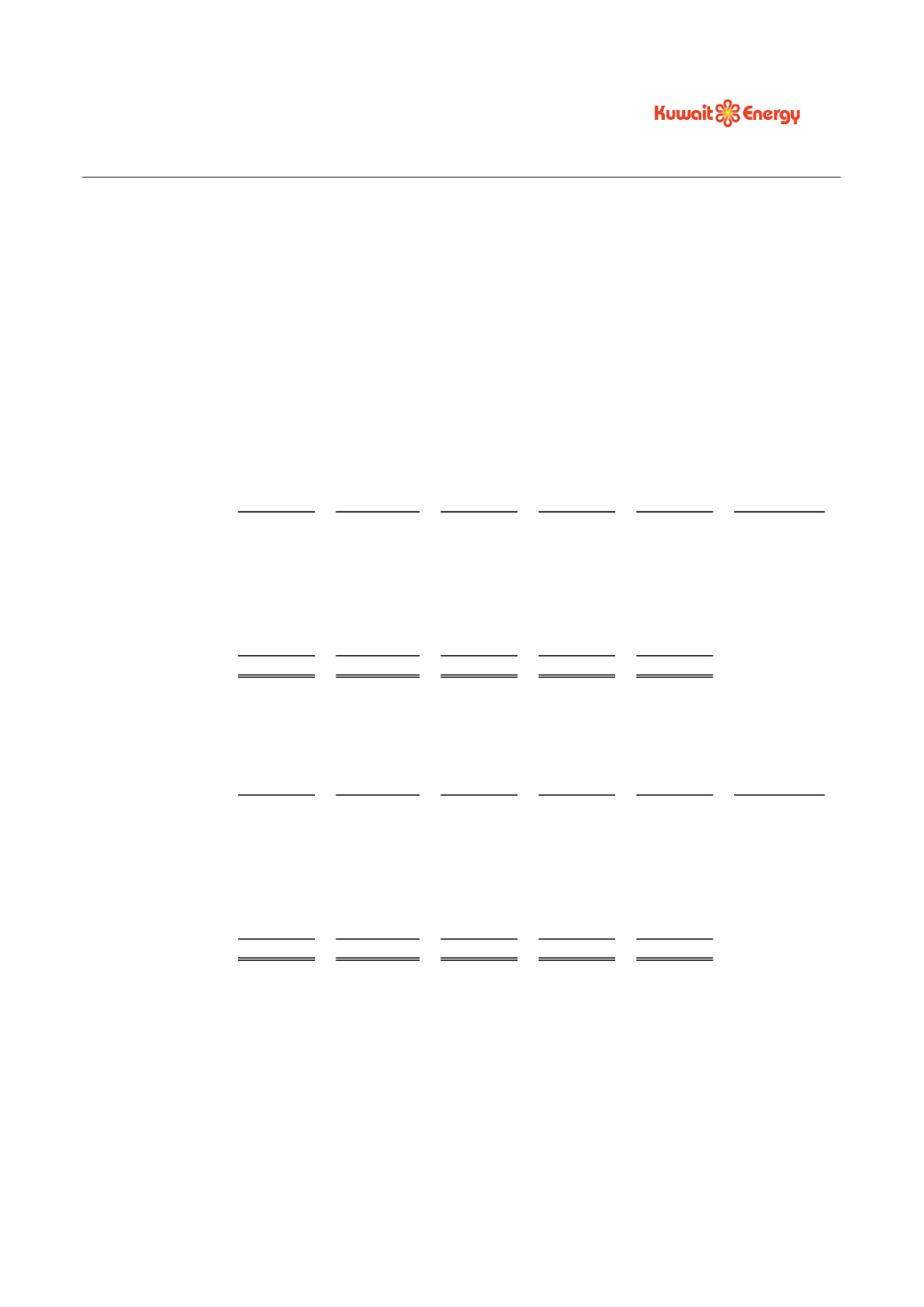

At 31 December 2012

Financial

liabilities

Less than

1 year

Between

1 and 3

years

Between

3 and 5

years

More

than 5

years

Total

Weighted

average

effective

interest rate

USD

000’s

USD

000’s

USD

000’s

USD

000’s

USD

000’s

%

Long-term

loans

3,306

6,654

66,600

-

76,560

6.62%

Convertible

loans

7,359

16,000

16,000

89,967

129,326

16%

Trade and other

payables

44,401

-

-

-

44,401

-

55,066

22,654

82,600

89,967

250,287