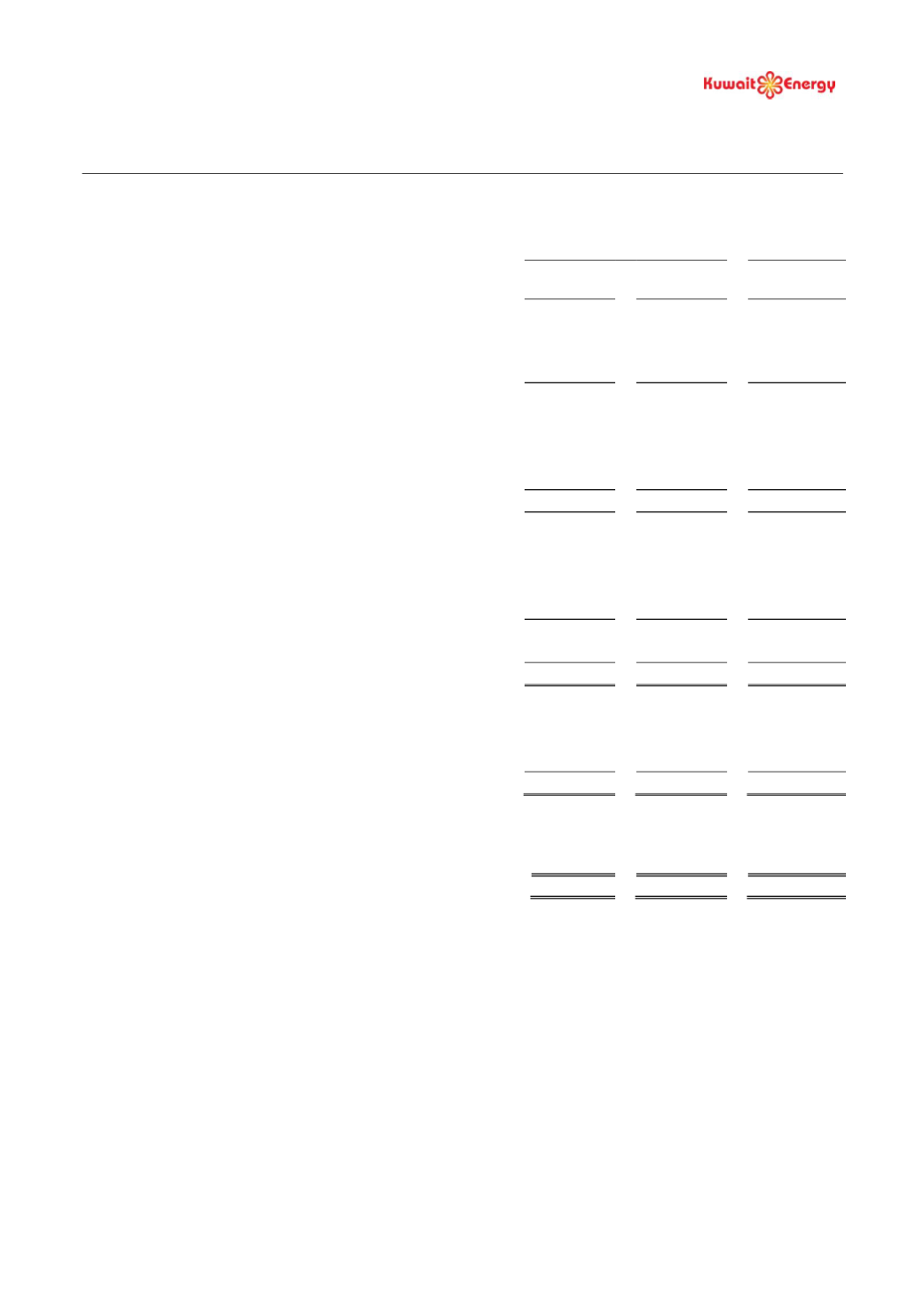

KUWAIT ENERGY PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

For the nine month period ended 30 September 2017

4

Nine month period ended

30 September

Year ended

31 December

2017

2016

2016

Unaudited

Unaudited

Audited

Notes

US$ 000’s

US$ 000’s

US$ 000’s

Continuing Operations

Revenue

145,869

97,446

138,895

Cost of sales

(71,695)

(80,506)

(106,556)

Gross profit

74,174

16,940

32,339

Exploration expenditure written off

6

(1,540)

-

-

Net impairment of oil and gas assets

7

(3,876)

-

(94,337)

Loss on assets classified as held for sale

10

(2,616)

-

-

General and administrative expenses

(17,952)

(11,657)

(18,970)

Operating profit/(loss)

48,190

5,283

(80,968)

Share of results of joint venture

1,773

(767)

1,451

Change in fair value of convertible loans

(23,158)

(10,118)

(24,774)

Other income

842

1,049

1,335

Foreign exchange gain/(loss)

302

(42)

(2,340)

Finance costs

(10,381)

(6,975)

(9,365)

Profit/(loss) before tax

17,568

(11,570)

(114,661)

Taxation charge

4

(5,838)

(837)

(1,456)

Profit/(loss) for the period

11,730

(12,407)

(116,117)

Attributable to:

Owners of the Company

11,722

(12,430)

(116,145)

Non-controlling interests

8

23

28

11,730

(12,407)

(116,117)

Earnings/(loss) per share attributable to owners of the Company

-

Basic (cents)

5

3.6

(3.8)

(35.6)

-

Diluted (cents)

5

3.6

(3.8)

(35.6)