KUWAIT ENERGY PLC

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

For the nine month period ended 30 September 2017

10

3.

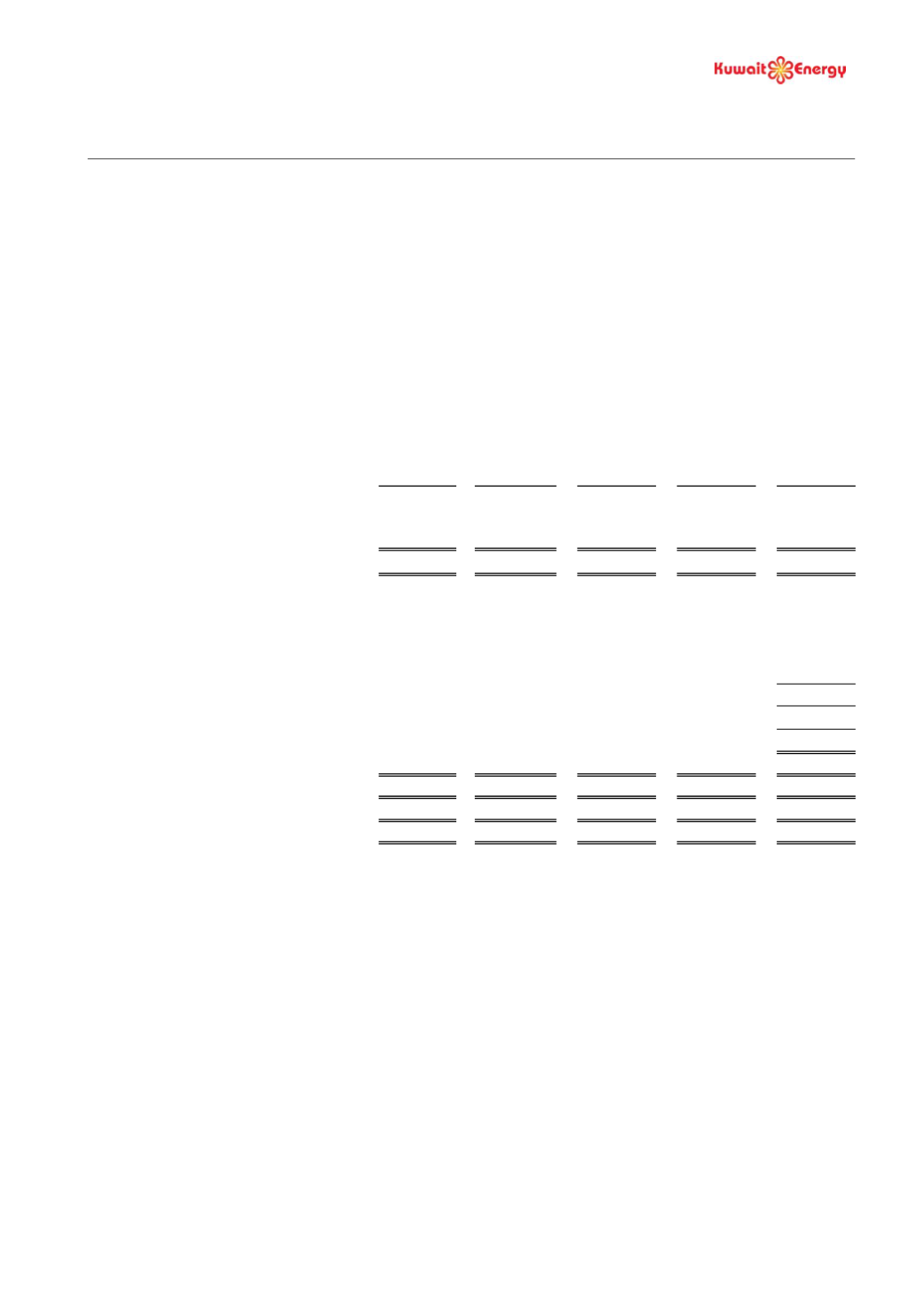

SEGMENTAL INFORMATION

Information reported to the Group’s Executive Management, the chief operating decision maker, for the purposes of

resource allocation and assignment of segment performance is specifically focused on the geographical area, namely

Egypt, Iraq, Yemen and rest of the world (included in others). The Group has one class of business, being the

exploration, development, production and sale of crude oil and natural gas.

Other operations include unallocated expenditure and liabilities of a corporate nature comprising the Company’s

external debt and other non-attributable corporate liabilities. The unallocated capital expenditure for each period

comprises the acquisition of non-attributable corporate assets.

There has been no change in the basis of segmentation or in the basis of measurement of segment profit or loss in the

period.

The following is an analysis of the Group’s revenue and results by reportable segments:

Egypt

Iraq

Yemen

Others

Total

US$ 000’s US$ 000’s

US$ 000’s US$ 000’s US$ 000’s

30 September 2017

Segment revenues

81,592

64,277

-

-

145,869

Segment operating profit/(loss)

37,826

27,268

(2,762)

(14,142)

48,190

Share of results of joint venture

1,773

Change in fair value of convertible loans

(23,158)

Other income

842

Foreign exchange gain

302

Finance costs

(10,381)

Profit before tax

17,568

Taxation charge

(5,838)

Profit for the period

11,730

Segment assets

220,106

492,129

80,047

27,921

820,203

E&E assets

4,380

-

22,180

-

26,560

PP&E

103,164

393,283

45,725

781

542,953

Segment liabilities

25,344

83,964

19,086

440,363

568,757

Other information:

Net impairment of oil and gas assets

-

3,876

-

-

3,876

Exploration expenditure written off

1,540

-

-

-

1,540

Additions to E&E

1,717

-

476

-

2,193

Additions to PP&E

3,768

74,821

313

-

78,902

Depreciation, Depletion and

Amortisation

20,412

22,586

-

229

43,227