`

5

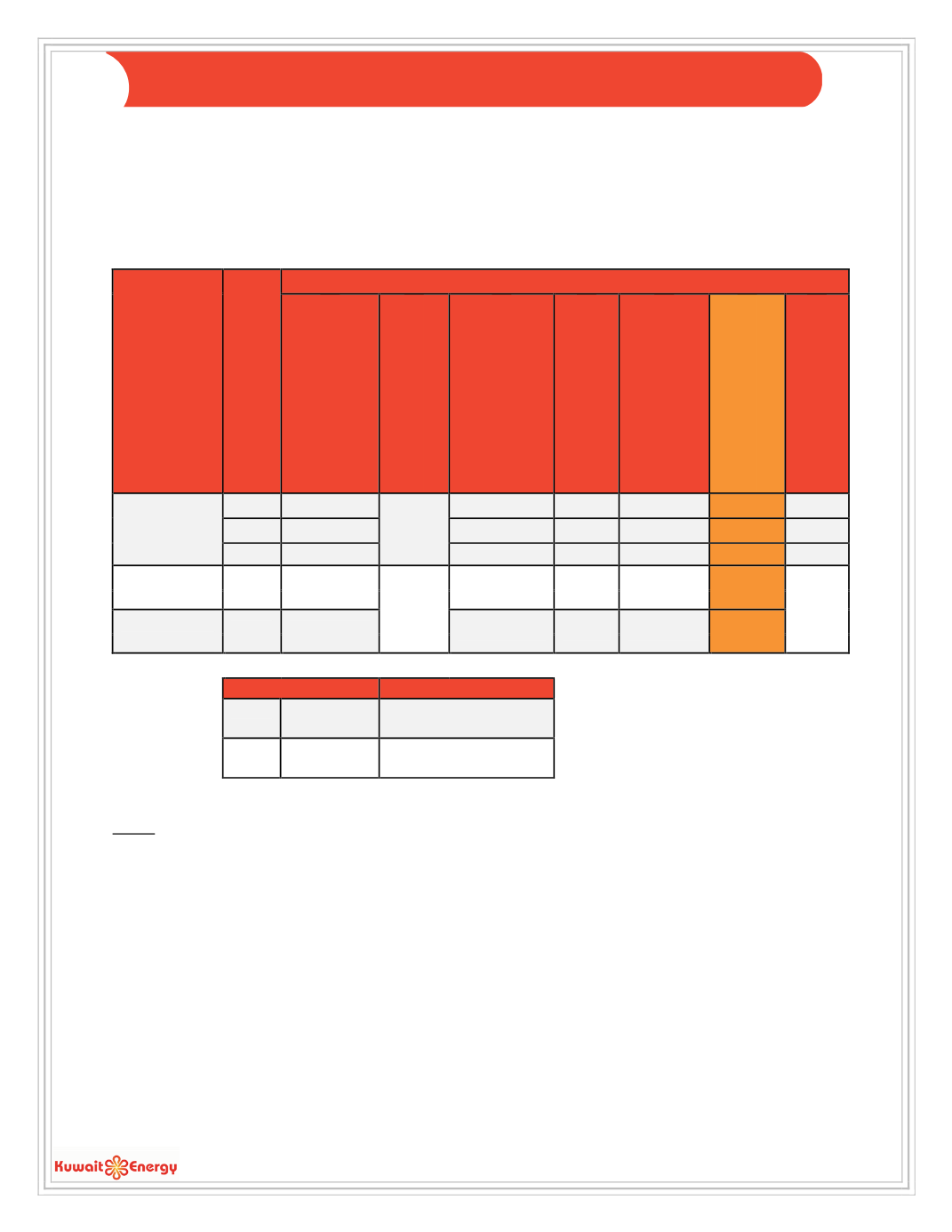

As of 31

st

December 2016, Kuwait Energy’s WI Proven and Probable (“2P”) reserves are

810 mmboe

; a decrease

from the previous year by 1%. The WI contingent resources (“2C”) is

1,040 mmboe

and the best estimate of risked

prospective resources (“P50”) is

28 mmboe

.

It is worth noting that

the

valuation of a private E&P company is most commonly based on its audited reserves

and associated economic models.

Classification

Category

Kuwait Energy Reserves and Resources (in mmboe)

YE15

2016 Production

Exploration Adds

Revisions

Acquisitions & Divestments

Year-End 2016

YE16 Net Entitlement

Reserves

1P

312

-8

0

33

-9

328

91

2P

818

0

21

-21

810

142

3P

1,651

0

38

-25

1,656

215

Contingent

Resources

2C

942

0

181

-84

1,040

Prospective

Resources

Best

34

0

0

-6

34

Total

YE16

YE15

1P

RRR =

301%

1P RRR = 780%

2P

RRR =

-5%

2P RRR = 1986%

Notes:

•

Audited figures by GCA as of 31 December 2016.

•

Excludes KSF, Oman which cannot be included in external reserves reporting as per the service contract.

•

Reserves Replacement Ratio considers acquisitions and divestment.

•

Prospective Resources estimates are risked.

•

N/E stands for Net Entitlement.

•

Totals may not exactly equal the sum of the individual entries due to rounding to nearest whole number.

•

20% of Siba, Iraq was divested to EGPC effective 1

st

January 2016.

•

25% of Abu Sennan, Egypt was divested to GlobalConnect effective 31

st

December 2016.

R

ESERVES AND

R

ESOURCES