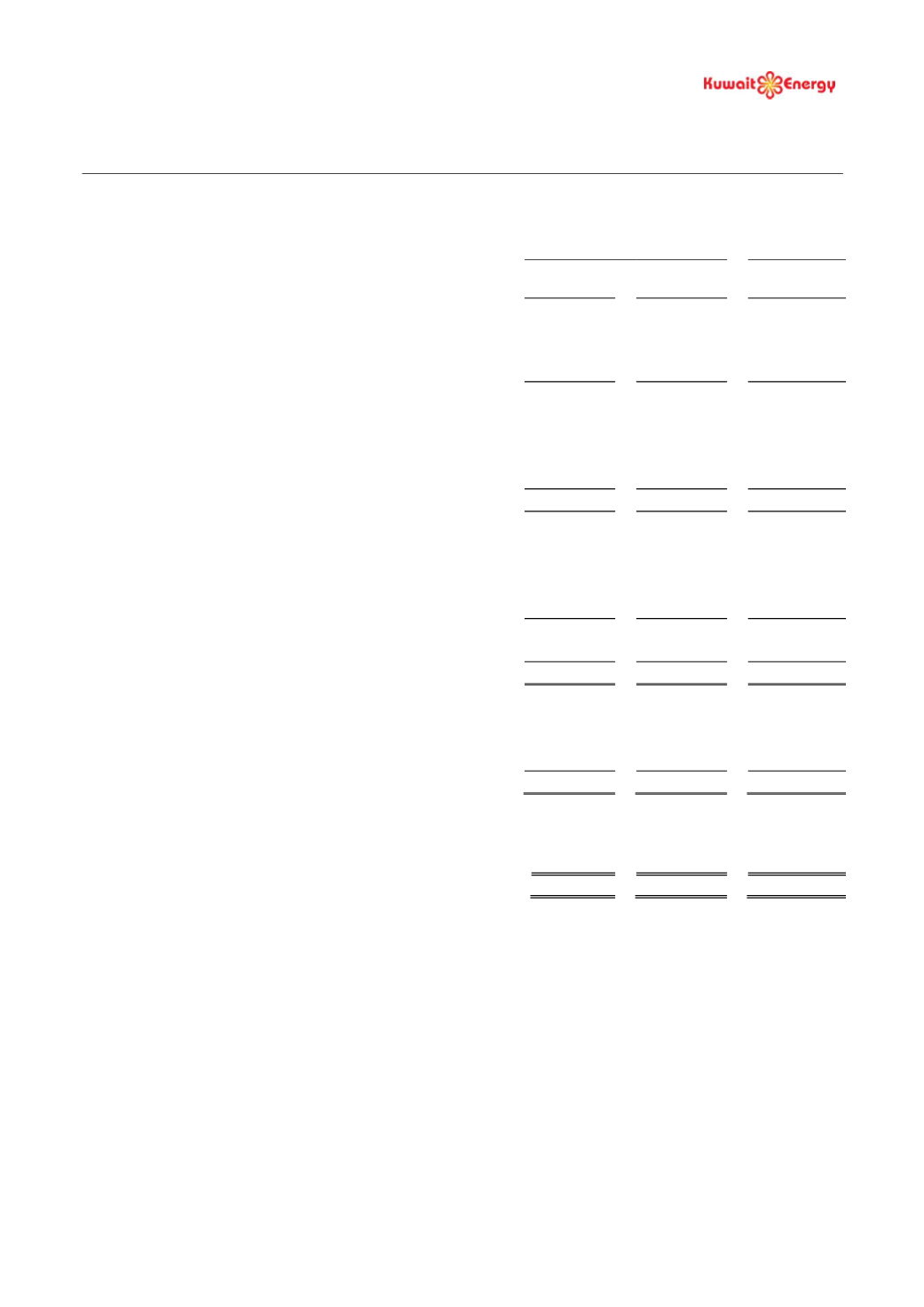

KUWAIT ENERGY PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

For the six month period ended 30 June 2017

5

Six month period ended

30 June

Year ended

31 December

2017

2016

2016

Unaudited

Audited

Audited

Notes

US$ 000’s

US$ 000’s

US$ 000’s

Continuing Operations

Revenue

95,398

64,819

138,895

Cost of sales

(49,201)

(57,507)

(106,556)

Gross profit

46,197

7,312

32,339

Exploration expenditure written off

(1,531)

-

-

Impairment of oil and gas assets

7

-

-

(94,337)

Loss on assets classified as held for sale

10

(1,873)

-

-

General and administrative expenses

(13,420)

(6,861)

(18,970)

Operating profit/(loss)

29,373

451

(80,968)

Share of results of joint venture

1,390

(628)

1,451

Change in fair value of convertible loans

(15,160)

(7,362)

(24,774)

Other income

537

835

1,335

Foreign exchange gain/(loss)

254

(57)

(2,340)

Finance costs

(6,789)

(4,650)

(9,365)

Profit/(loss) before tax

9,605

(11,411)

(114,661)

Taxation charge

4

(3,938)

222

(1,456)

Profit/(loss) for the period

5,667

(11,189)

(116,117)

Attributable to:

Owners of the Company

5,663

(11,211)

(116,145)

Non-controlling interests

4

22

28

5,667

(11,189)

(116,117)

Earnings/(loss) per share attributable to owners of the Company

-

Basic (cents)

5

1.7

(3.4)

(35.6)

-

Diluted (cents)

5

1.7

(3.4)

(35.6)